Google’s Vulnerability In Search Is Growing

Posted in: UncategorizedThe dip suggests the trend isn’t an anomaly, but a sign of mounting competitive pressure and shifting user behavior.

For 25 Years, The Sims Has Delivered Amusement, Distraction, and a Sense of Security

Posted in: UncategorizedThe Sims lets you “redefine life on your own terms—there is no judgement,” said EA’s Lyndsay Pearson.

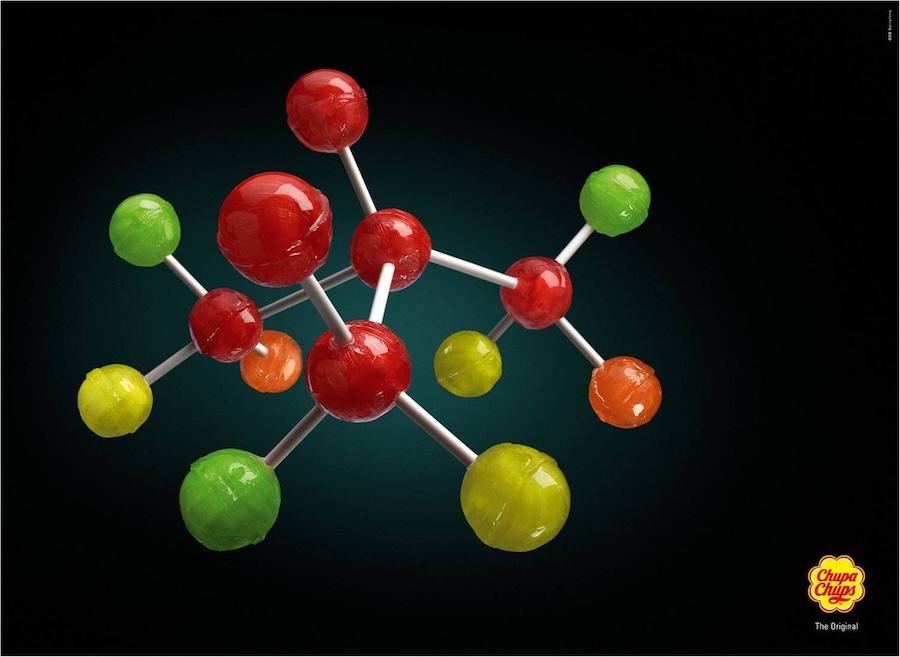

lollipops that form a molecule / Une belle resucée?

Posted in: Uncategorized |

|

| THE ORIGINAL? Chupa Chups « The original » – 2006 Click the image to enlarge Source : Cannes Lions Outdoor BRONZE Agency : DDB Madrid (Spain) |

LESS ORIGINAL Chupa Chups – 2025 Click the image to enlarge Source : Creative Salon Agency : BBH London (UK) |

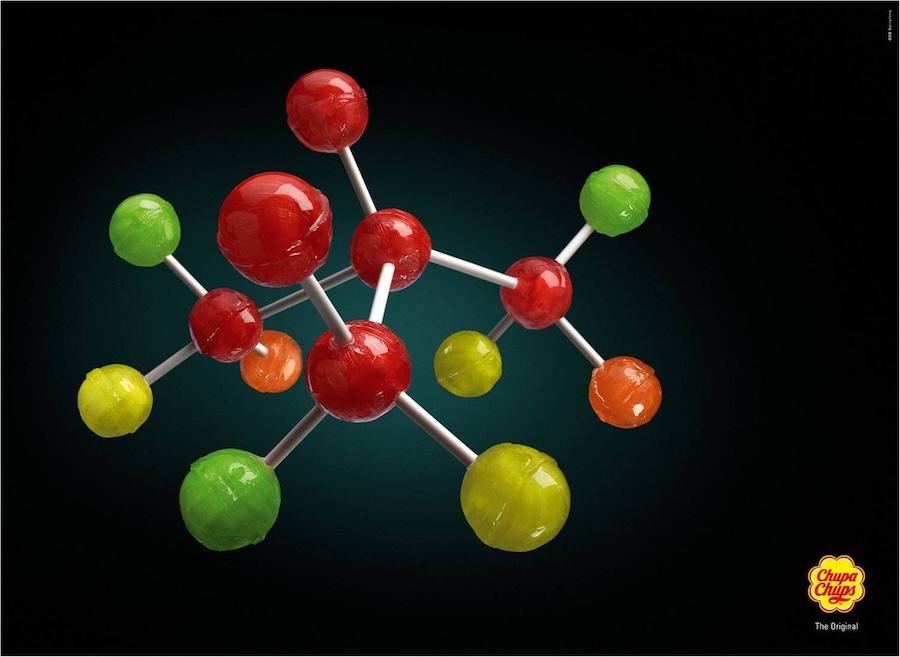

lollipops that form a molecule / Une belle resucée?

Posted in: Uncategorized |

|

| THE ORIGINAL? Chupa Chups « The original » – 2006 Click the image to enlarge Source : Cannes Lions Outdoor BRONZE Agency : DDB Madrid (Spain) |

LESS ORIGINAL Chupa Chups – 2025 Click the image to enlarge Source : Creative Salon Agency : BBH London (UK) |

Trump’s Tariffs Will Make AI Costs Soar, But Adoption Won’t Slow

Posted in: UncategorizedNew tariffs on countries like Taiwan (32%) and South Korea (25%) are expected to ripple through the AI supply chain.

NBC News Settles $30 Million Defamation Case With Georgia Doctor

Posted in: UncategorizedThe case stemmed from a report that aired on MSNBC in September 2020.

CarMax Selects 72andSunny Los Angeles as Creative Agency of Record

Posted in: UncategorizedThe used-car retailer is moving from The Martin Agency after a competitive review.

Built Rare by Century Real Estate

Posted in: UncategorizedBrand: Century Real Estate Pvt.Ltd

Head of Marketing: Vikas S Nair

Brand Manager: GN Ajai Kumar

Brand Executive: Priti Singh

Creative Head: Anudeep Yeluri

Art Head: Shashi Kiran V

Junior Visualiser: Abhay Kumar Raj

Copy Head: Mouli Bhattacharya

Media and Distribution: Rohit Edwin Philip

Digital Team: Sunil Vattikutii Sreenivas

Photographer: Tarun Khiwal

Production: Epitome

Built Rare by Century Real Estate

Posted in: UncategorizedBrand: Century Real Estate Pvt.Ltd

Head of Marketing: Vikas S Nair

Brand Manager: GN Ajai Kumar

Brand Executive: Priti Singh

Creative Head: Anudeep Yeluri

Art Head: Shashi Kiran V

Junior Visualiser: Abhay Kumar Raj

Copy Head: Mouli Bhattacharya

Media and Distribution: Rohit Edwin Philip

Digital Team: Sunil Vattikutii Sreenivas

Photographer: Tarun Khiwal

Production: Epitome

CarMax Selects 72andSunny Los Angeles as Creative Agency of Record

Posted in: UncategorizedThe used-car retailer is moving from The Martin Agency after a competitive review.

Portable Tire Inflators – Woowind's Ventus Pro Fills Tires in as Little as 1 Minute

Posted in: UncategorizedFor Most Brands, Tariffs Are Scary. American Giant Sees a Marketing Opportunity

Posted in: UncategorizedThe clothing brand was founded in 2011 by Bayard Winthrop.

For Most Brands, Tariffs Are Scary. American Giant Sees a Marketing Opportunity

Posted in: UncategorizedThe clothing brand was founded in 2011 by Bayard Winthrop.

For Most Brands, Tariffs Are Scary. American Giant Sees a Marketing Opportunity

Posted in: UncategorizedThe clothing brand was founded in 2011 by Bayard Winthrop.

Constellation Brands Pulls Back on Its DEI Programs

Posted in: UncategorizedThe Corona and Modelo Especial maker is making the changes recognizing the existing political climate.

CNBC and Fox Business See Viewership Soar Amid Market Chaos

Posted in: UncategorizedViewership of Fox Business and CNBC has soared since President Trump’s tariffs created chaos in the global economy.

Fox News Leads All News Outlets in YouTube Views for 1st Quarter of 2025

Posted in: UncategorizedFNC recorded 1.2 billion video views on YouTube during Q1 2025.

CNBC and Fox Business See Viewership Soar Amid Market Chaos

Posted in: UncategorizedViewership of Fox Business and CNBC has soared since President Trump’s tariffs created chaos in the global economy.

Meta Stands to Lose Tens of Billions of Ad Spend in Impending FTC Antitrust Trial

Posted in: UncategorizedIn its most substantive competition challenge to date, Meta is set to face off against the FTC. It could be forced to spin off Instagram and WhatsApp.