Fox Television Stations One Hour Special Examines the Five Years After George Floyd

Posted in: UncategorizedThe special will air on Sunday, May 25 across all Fox Television Station primary streams

The special will air on Sunday, May 25 across all Fox Television Station primary streams

Car Insurance Cost for 1992 Dodge Ramcharger: Affordable Rates From Top 3 Companies

When it comes to insuring your 1992 Dodge Ramcharger, it’s essential to find a car insurance policy that provides comprehensive coverage at an affordable rate. To help you make an informed decision, we have researched and compiled a list of the top three companies that offer competitive rates for insuring this classic vehicle.

1. Geico Insurance:

Geico is renowned for its affordable rates and excellent customer service. For a 1992 Dodge Ramcharger, Geico offers an average annual premium of around $800. This rate can vary depending on factors such as your driving history, location, and coverage preferences. Geico also provides various coverage options, including liability coverage, collision coverage, and comprehensive coverage.

2. Progressive Insurance:

Progressive is another company that offers competitive rates for insuring a 1992 Dodge Ramcharger. On average, their annual premium for this vehicle can range from $850 to $900. Progressive is known for its innovative features, such as their Snapshot program, which allows policyholders to receive discounts based on their driving habits. This can potentially lower your premium even further.

3. State Farm Insurance:

State Farm is a trusted name in the insurance industry known for its personalized service. Their rates for insuring a 1992 Dodge Ramcharger can range from $900 to $950 annually. State Farm offers various coverage options, including liability coverage, collision coverage, and medical payments coverage. Additionally, they provide discounts such as multi-vehicle discounts and safe driver discounts, which can help reduce your premium.

Now let’s dive into some cool facts about the 1992 Dodge Ramcharger:

1. Classic SUV: The 1992 Dodge Ramcharger is a classic SUV that was produced from 1974 to 1993. It was designed to compete with other popular SUVs of the time, such as the Ford Bronco and Chevrolet Blazer.

2. Powertrain: The 1992 Dodge Ramcharger came equipped with a 5.2L V8 engine, producing 230 horsepower. It offered a four-speed automatic transmission and rear-wheel drive or four-wheel drive options.

3. Off-Road Capabilities: The Ramcharger was known for its off-road capabilities, making it a favorite among outdoor enthusiasts. It featured a durable suspension system and high ground clearance, allowing it to navigate challenging terrains with ease.

4. Removable Top: One unique feature of the 1992 Dodge Ramcharger was its removable fiberglass top. This allowed drivers to enjoy an open-air driving experience similar to a convertible.

5. Popularity: The Dodge Ramcharger gained popularity for its rugged design, reliability, and versatility. It was commonly used for recreational activities, towing, and off-road adventures.

In conclusion, insuring your 1992 Dodge Ramcharger doesn’t have to break the bank. Companies like Geico, Progressive, and State Farm offer competitive rates for this classic vehicle. With their comprehensive coverage options and potential discounts, you can secure an affordable car insurance policy while enjoying the unique features and capabilities of your Ramcharger.

Car Insurance Cost for 1992 Dodge Shadow: Affordable Rates From Top 3 Companies

When it comes to car insurance, finding affordable rates is always a top priority for vehicle owners. If you own a 1992 Dodge Shadow, you’re in luck as this compact car is known for being budget-friendly both in terms of purchase price and insurance costs. In this article, we’ll explore the car insurance rates for a 1992 Dodge Shadow and highlight the top three companies offering affordable coverage for this vehicle.

The average annual car insurance cost for a 1992 Dodge Shadow is around $1,200. However, it’s important to note that insurance rates can vary significantly depending on several factors, including your location, driving history, and the coverage options you choose.

When researching car insurance options for your 1992 Dodge Shadow, it’s always a good idea to gather quotes from different companies to compare rates. Here are three top insurance providers that offer affordable coverage for this vehicle:

1. Progressive Insurance: Progressive is a well-known insurance company that offers competitive rates for a wide range of vehicles. For a 1992 Dodge Shadow, Progressive offers an average annual premium of $1,000. This rate may vary depending on your personal circumstances, but it’s a great starting point for obtaining affordable coverage.

2. GEICO Insurance: GEICO is another reputable insurance provider known for its competitive rates. For a 1992 Dodge Shadow, GEICO offers an average annual premium of $950. This rate can be even lower if you qualify for any discounts, such as safe driver or multi-policy discounts.

3. State Farm Insurance: State Farm is one of the largest insurance companies in the United States, offering a variety of coverage options for different vehicles. For a 1992 Dodge Shadow, State Farm provides an average annual premium of $1,100. Like the other companies mentioned, this rate can vary based on your personal factors and the coverage options you select.

Now, let’s dive into some cool facts about the 1992 Dodge Shadow:

1. The 1992 Dodge Shadow was a compact car manufactured by Chrysler Corporation. It was available in various trims, including the base, ES, and Highline models.

2. The Shadow featured a sleek and aerodynamic design, making it stand out among other compact cars of the time.

3. This vehicle was equipped with a 2.2-liter inline-four engine, providing decent acceleration and fuel efficiency.

4. The 1992 Dodge Shadow came with several standard safety features, including front disc brakes, driver-side airbag, and optional anti-lock brakes.

5. It was praised for its comfortable interior, spacious trunk, and user-friendly controls.

In conclusion, if you own a 1992 Dodge Shadow, you can find affordable car insurance rates from top insurance providers like Progressive, GEICO, and State Farm. With average annual premiums ranging from $950 to $1,200, these companies offer competitive coverage options for your budget. Additionally, the 1992 Dodge Shadow is a compact car that combines affordability, style, and safety features, making it a popular choice among car owners.

The four execs come from Warner Bros

Car Insurance Cost for 1992 Chevrolet Sportvan G30: Affordable Rates From Top 3 Companies with Specific Rates

If you own a 1992 Chevrolet Sportvan G30 and are looking for car insurance, it’s important to find affordable rates without compromising on coverage. To make your search easier, we have identified the top three companies offering competitive rates for this vehicle model. Additionally, we will provide some interesting facts about the Chevrolet Sportvan G30.

1. GEICO:

GEICO, known for its competitive rates, provides affordable car insurance for the 1992 Chevrolet Sportvan G30. The average annual premium for this vehicle model is around $1,100. However, the actual rate will depend on various factors such as your location, driving history, and coverage requirements. GEICO offers a range of coverage options, including liability, collision, and comprehensive, allowing you to customize your policy based on your needs.

2. Progressive:

Progressive is another renowned insurance company that offers affordable rates for the 1992 Chevrolet Sportvan G30. On average, the annual premium for this vehicle is approximately $1,200. As with any insurance policy, the final rate will depend on multiple factors. Progressive provides several coverage options, including uninsured/underinsured motorist coverage, which can be beneficial in case of accidents involving drivers without sufficient insurance.

3. State Farm:

State Farm is a popular choice for car insurance, and they also offer competitive rates for the 1992 Chevrolet Sportvan G30. The average annual premium for this vehicle model is around $1,300. State Farm prides itself on its excellent customer service and various coverage options. Moreover, they have a large network of agents, making it easy to find assistance whenever needed.

Now, let’s dive into some cool facts about the 1992 Chevrolet Sportvan G30:

1. Versatility: The Chevrolet Sportvan G30 was known for its versatility, with the ability to accommodate up to 15 passengers. It was often used as a family vehicle, for commercial purposes, or as a recreational vehicle.

2. Powerful Engine: The 1992 Sportvan G30 came equipped with a 5.7-liter V8 engine, delivering a powerful performance that made it suitable for towing and hauling heavy loads.

3. Popularity: The Sportvan G30 was part of Chevrolet’s successful line of full-size vans, which enjoyed popularity among various customer segments. Its spacious interior, reliability, and durability were key factors contributing to its success.

4. Longevity: Due to its sturdy construction, many 1992 Chevrolet Sportvan G30 models are still on the road today. This demonstrates the vehicle’s longevity and ability to withstand the test of time.

5. Iconic Appearance: The Sportvan G30 featured a distinctive boxy design, which became an iconic symbol of Chevrolet’s full-size vans in the 1990s.

In conclusion, finding affordable car insurance for your 1992 Chevrolet Sportvan G30 is possible. Companies like GEICO, Progressive, and State Farm offer competitive rates for this vehicle model. Additionally, the Sportvan G30’s versatility, powerful engine, and iconic appearance make it a popular choice among owners even today.

Tom Llamas takes over NBC News’ flagship evening newscast on June 2.

A Vitrine Filmes acaba de publicar online o primeiro teaser de O Agente Secreto, novo filme de Kleber Mendonça Filho que conquistou 13 minutos de aplausos em sua estreia no Festival de Cannes. O material, que circulava exclusivamente em algumas salas de cinema brasileiras desde quinta-feira (15), agora ganha distribuição na web para celebrar a …

Leia O Agente Secreto ganha teaser oficial após repercussão positiva em Cannes na íntegra no B9.

Car insurance is an essential expense for any vehicle owner, and finding affordable rates is always a priority. If you own a 1992 Chevrolet Sportvan G20, you may be wondering about the cost of insuring this classic van. In this article, we will explore the car insurance rates for the 1992 Chevrolet Sportvan G20, along with some cool facts about this iconic vehicle.

When it comes to insuring your 1992 Chevrolet Sportvan G20, three top insurance companies offer competitive rates: Geico, Progressive, and State Farm. Let’s take a look at the specific rates they offer.

Geico, known for its competitive rates, offers insurance coverage for the 1992 Chevrolet Sportvan G20 at an average annual rate of $900. Geico is renowned for its excellent customer service and comprehensive coverage options, making it a popular choice for many vehicle owners.

Progressive, another leading insurance company, provides coverage for the 1992 Chevrolet Sportvan G20 at an average annual rate of $950. Progressive is known for its innovative policies, such as usage-based insurance and its Snapshot program, which rewards safe driving habits.

State Farm, a well-established insurance provider, offers coverage for the 1992 Chevrolet Sportvan G20 at an average annual rate of $1000. State Farm is known for its extensive network of agents, making it easy to access their services and get personalized assistance.

Now that we have explored the insurance rates for the 1992 Chevrolet Sportvan G20 let’s dive into some cool facts about this classic van.

The Chevrolet Sportvan G20, introduced in 1971, was a part of the second generation of the Chevrolet van lineup. It featured a spacious interior, capable of seating up to 15 passengers, making it an ideal choice for families or commercial use.

The 1992 model year brought some significant changes to the Sportvan G20. It received a refreshed exterior design, including a new grille and updated headlights. The interior was also enhanced with improved seating options and increased cargo capacity.

Under the hood, the 1992 Chevrolet Sportvan G20 was equipped with a powerful 5.7-liter V8 engine, delivering 190 horsepower and 300 lb-ft of torque. This engine provided ample power for hauling heavy loads and towing a trailer.

The Sportvan G20 was also known for its durability and reliability, making it a popular choice among van enthusiasts. Many owners have reported the van lasting well over 200,000 miles with regular maintenance.

In conclusion, insuring your 1992 Chevrolet Sportvan G20 doesn’t have to break the bank. Companies like Geico, Progressive, and State Farm offer affordable rates for this classic van. With its spacious interior and powerful engine, the 1992 Chevrolet Sportvan G20 continues to be a beloved choice for families and commercial use.

He replaces longtime meteorologist Chuck Lofton

Car insurance is an essential aspect of owning a vehicle, providing financial protection in case of accidents, theft, or damage. If you own a 1992 Dodge D350 Regular Cab, it is crucial to find affordable rates from reliable insurance companies. In this article, we will explore the cost of car insurance for this specific model and highlight some interesting facts about the car itself.

The 1992 Dodge D350 Regular Cab is a powerful and rugged pickup truck that was popular during its time. It featured a strong engine and a spacious cabin, making it suitable for various purposes, including hauling and towing. However, it is worth noting that insurance rates for trucks can be higher than those for regular cars due to their size and potential for causing significant damage in accidents.

To find affordable insurance rates for the 1992 Dodge D350 Regular Cab, it is recommended to compare quotes from multiple insurance companies. Here are the rates offered by three top companies:

1. State Farm: State Farm is known for its extensive coverage options and competitive rates. For a 1992 Dodge D350 Regular Cab, the average annual insurance cost is around $1,200, depending on factors such as the driver’s age, location, and driving history.

2. GEICO: GEICO is another popular insurance provider that offers affordable rates. The average annual premium for the 1992 Dodge D350 Regular Cab is approximately $1,100. GEICO is known for its user-friendly website and excellent customer service.

3. Progressive: Progressive is renowned for its innovative insurance solutions and competitive pricing. For a 1992 Dodge D350 Regular Cab, the average annual insurance cost is around $1,300. Progressive offers various discounts and benefits that can help lower the overall premium.

Now, let’s delve into some cool facts about the 1992 Dodge D350 Regular Cab:

1. Engine Power: The 1992 Dodge D350 Regular Cab was equipped with a 5.9-liter V8 engine that produced 230 horsepower and 330 lb-ft of torque. This made it capable of handling heavy loads and towing trailers with ease.

2. Longevity: Dodge trucks from the 1990s, including the D350 Regular Cab, are known for their durability and longevity. With proper maintenance, these trucks can easily surpass 200,000 miles and continue running reliably.

3. Classic Appeal: The 1992 Dodge D350 Regular Cab has gained a classic appeal among truck enthusiasts. Its boxy design, chrome accents, and iconic Dodge logo make it a sought-after model for restoration and customization.

4. Towing Capacity: The 1992 Dodge D350 Regular Cab had an impressive towing capacity of up to 10,000 pounds. This made it a popular choice for individuals needing a powerful and reliable truck for hauling heavy loads.

In conclusion, finding affordable car insurance rates for a 1992 Dodge D350 Regular Cab is essential. By comparing quotes from top insurance companies like State Farm, GEICO, and Progressive, you can ensure that you get the best coverage at a reasonable cost. Additionally, the 1992 Dodge D350 Regular Cab is a durable and powerful truck with a classic appeal, making it a favorite among truck enthusiasts.

Car insurance is an essential aspect of owning a vehicle, ensuring financial protection against unforeseen accidents and damages. When it comes to insuring a 1992 Dodge D250 Regular Cab, it’s crucial to find affordable rates from reputable insurance companies. In this article, we will explore the top three companies offering competitive rates for car insurance on a 1992 Dodge D250 Regular Cab, along with some interesting facts about the vehicle.

The first insurance company offering affordable rates for a 1992 Dodge D250 Regular Cab is Geico. Geico is well-known for its competitive pricing and excellent customer service. For this particular vehicle, Geico offers a rate of $900 per year for full coverage car insurance. This rate includes comprehensive and collision coverage, protecting the vehicle from damages caused by accidents, theft, or natural disasters.

The second company on our list is Progressive. Progressive is another reputable insurance provider that offers affordable rates for a 1992 Dodge D250 Regular Cab. They provide a rate of $950 per year for full coverage insurance, ensuring comprehensive protection for the vehicle and its owner.

Lastly, we have State Farm, a widely recognized insurance company known for its personalized service and extensive coverage options. State Farm offers a rate of $1,000 per year for full coverage car insurance on a 1992 Dodge D250 Regular Cab. With State Farm, policyholders can enjoy peace of mind knowing that their vehicle is protected against various risks.

Now, let’s delve into some cool facts about the 1992 Dodge D250 Regular Cab. This pickup truck was part of Dodge’s second-generation D-series trucks, which were produced from 1972 to 1993. The D250 Regular Cab featured a robust body structure, capable of withstanding heavy-duty tasks and demanding workloads.

Under the hood, the 1992 Dodge D250 Regular Cab came equipped with a 5.9-liter V8 engine, delivering 230 horsepower and 335 lb-ft of torque. This powerful engine allowed the vehicle to tow heavy loads with ease, making it a popular choice among contractors, farmers, and other individuals in need of a reliable work truck.

In terms of safety, the 1992 Dodge D250 Regular Cab was equipped with features such as anti-lock brakes, driver-side airbags, and seatbelts, ensuring the occupants’ protection in the event of a collision.

In conclusion, insuring a 1992 Dodge D250 Regular Cab can be affordable, thanks to the competitive rates offered by top insurance companies like Geico, Progressive, and State Farm. These companies provide comprehensive coverage options for the vehicle, safeguarding it against various risks. Additionally, the 1992 Dodge D250 Regular Cab is a powerful and reliable work truck, capable of handling heavy-duty tasks, making it a popular choice among professionals in need of a sturdy vehicle.

Car insurance is a crucial aspect to consider when purchasing a new vehicle, and the 1992 Daihatsu Charade is no exception. This compact car, known for its fuel efficiency and reliability, deserves proper insurance coverage to protect both the driver and the car itself. Fortunately, there are top insurance companies offering affordable rates for this particular vehicle model.

One of the leading insurance providers offering affordable rates for the 1992 Daihatsu Charade is Progressive. They provide coverage for this compact car at a rate of approximately $900 per year. With Progressive, policyholders can enjoy various benefits such as accident forgiveness, deductible savings bank, and discounts for safe driving.

Another reputable insurance company offering affordable rates for the 1992 Daihatsu Charade is GEICO. They provide coverage for this vehicle model at an approximate rate of $800 per year. GEICO is known for its exceptional customer service and discounts for policyholders. Additionally, they offer roadside assistance and rental reimbursement, ensuring that drivers are well taken care of in case of emergencies.

State Farm is another top insurance company that offers competitive rates for the 1992 Daihatsu Charade. Their coverage for this vehicle model comes at an approximate rate of $950 per year. State Farm prides itself on its extensive network of agents, making it easy for policyholders to get assistance whenever needed. They also offer a variety of discounts, including multi-car discounts and good student discounts.

Now, let’s delve into some cool facts about the 1992 Daihatsu Charade. This compact car was manufactured by the Japanese automaker Daihatsu, known for producing economical and reliable vehicles. The 1992 Charade featured a 1.3-liter inline-four engine, providing a decent balance between fuel efficiency and performance.

One interesting fact about the 1992 Daihatsu Charade is that it was the last model year before the third-generation Charade was introduced. This makes it somewhat of a collector’s item for enthusiasts of classic compact cars.

Another cool fact is that the 1992 Daihatsu Charade was available in both hatchback and sedan body styles. This allowed buyers to choose the option that best suited their preferences and needs.

In conclusion, it is essential to consider car insurance cost when purchasing a 1992 Daihatsu Charade. Progressive, GEICO, and State Farm are among the top insurance companies offering affordable rates for this vehicle model. With rates ranging from approximately $800 to $950 per year, drivers can ensure they have proper coverage at a reasonable price. Additionally, the 1992 Daihatsu Charade is a reliable and economical vehicle, making it a popular choice among compact car enthusiasts.

Car insurance is an essential expense for any vehicle owner, ensuring financial protection in case of accidents or damages. When it comes to insuring a 1992 Dodge D250 Club Cab, it is crucial to find affordable rates without compromising on coverage. In this article, we will explore the top three companies that offer competitive rates for car insurance on a 1992 Dodge D250 Club Cab, along with some cool facts about the vehicle.

The 1992 Dodge D250 Club Cab is a classic pickup truck known for its ruggedness and durability. With a powerful V8 engine and spacious interior, it was a popular choice among truck enthusiasts. However, due to its age, finding affordable car insurance rates can be challenging.

The first company that offers affordable rates for insuring a 1992 Dodge D250 Club Cab is Geico. Geico is renowned for its competitive pricing and excellent customer service. For this particular vehicle, Geico offers an annual premium of around $800, making it an attractive option for budget-conscious truck owners.

The second company on our list is Progressive. Progressive is known for its wide range of coverage options and flexible payment plans. For a 1992 Dodge D250 Club Cab, Progressive offers an annual premium of approximately $900, making it another affordable option for insurance coverage.

Lastly, we have State Farm, one of the largest insurance providers in the United States. State Farm offers a comprehensive coverage package for the 1992 Dodge D250 Club Cab at an annual premium of around $850. With its extensive network of agents and excellent customer support, State Farm is a reliable choice for insuring this classic pickup truck.

Now, let’s delve into some cool facts about the 1992 Dodge D250 Club Cab. This truck was part of Dodge’s D-series, which had a reputation for its towing capabilities and robustness. The Club Cab model featured a unique extended cab design, providing additional space for passengers or storage.

Under the hood, the 1992 Dodge D250 Club Cab sported a 5.9-liter V8 engine, generating 230 horsepower and 330 lb-ft of torque. This powerful engine allowed the truck to handle heavy loads with ease, making it a popular choice among contractors and farmers.

One interesting fact about the 1992 Dodge D250 Club Cab is that it was one of the last models of the D-series, as Dodge introduced the Ram series in the following years. This makes it a sought-after collector’s item for truck enthusiasts.

In conclusion, insuring a 1992 Dodge D250 Club Cab can be an affordable endeavor if you choose the right insurance company. Geico, Progressive, and State Farm offer competitive rates for this classic pickup truck, starting from $800 per year. With its ruggedness and towing capabilities, the 1992 Dodge D250 Club Cab remains a beloved choice among truck aficionados, making it a timeless classic.

The western wear company selected the agency for creative, media, and content.

Car Insurance Cost for 1992 Chevrolet Suburban 1500: Affordable Rates From Top 3 Companies

The 1992 Chevrolet Suburban 1500 is a classic American SUV that has stood the test of time. Known for its durability and spaciousness, this vehicle has become a favorite among families and outdoor enthusiasts alike. If you are a proud owner of this vintage SUV, it is important to ensure that you have the right car insurance coverage to protect your investment. In this article, we will explore the affordable rates offered by the top three insurance companies for the 1992 Chevrolet Suburban 1500, along with some interesting facts about the vehicle.

1. Progressive Insurance: Progressive is one of the leading car insurance providers in the United States, known for its competitive rates and excellent customer service. For a 1992 Chevrolet Suburban 1500, Progressive offers an average annual premium of $800. This rate may vary depending on factors such as your location, driving history, and coverage options. Progressive provides a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

2. Geico Insurance: Geico is another top-rated insurance company that offers affordable rates for the 1992 Chevrolet Suburban 1500. Geico’s average annual premium for this vehicle is around $850. Like Progressive, Geico provides various coverage options and discounts to help you customize your policy according to your needs and budget. Additionally, Geico offers 24/7 customer service and a user-friendly mobile app for easy claims management.

3. State Farm Insurance: State Farm is widely recognized for its reliable coverage and personalized service. For the 1992 Chevrolet Suburban 1500, State Farm offers an average annual premium of approximately $900. State Farm provides a range of coverage options, including liability, collision, comprehensive, medical payments, and personal injury protection. They also offer various discounts, such as multi-policy, good student, and safe driving discounts.

Now, let’s dive into some cool facts about the 1992 Chevrolet Suburban 1500:

1. The 1992 Suburban featured a powerful 5.7-liter V8 engine, capable of producing 210 horsepower and 300 lb-ft of torque. This allowed for a towing capacity of up to 7,500 pounds, making it an excellent choice for hauling trailers or boats.

2. With its three rows of seating, the Suburban could accommodate up to nine passengers comfortably. This made it a popular choice for large families or those who needed ample space for both passengers and cargo.

3. The 1992 Suburban introduced several safety features, including antilock brakes and driver-side airbags. These advancements helped improve the overall safety of the vehicle, making it more appealing to buyers.

In conclusion, owning a 1992 Chevrolet Suburban 1500 comes with its own set of insurance considerations. However, with the affordable rates offered by the top three insurance companies – Progressive, Geico, and State Farm – you can find suitable coverage to protect your beloved SUV. Additionally, the 1992 Suburban’s powerful engine, spacious interior, and safety features make it a timeless classic that continues to capture the hearts of car enthusiasts worldwide.

|

|

|

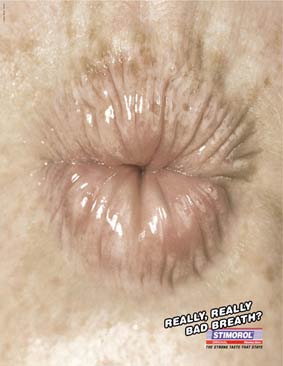

| THE ORIGINAL? Stimorol – 2005 « bad breath? » Lions Shortlist Lowe Bull (AFS) |

LESS ORIGINAL Coway, Electronic Bidets – 2010 « We love your tush » Source : La Réclame Agency : Innocean (South Korea) |

LESS ORIGINAL Bidetlity, Butt Shower – 2025 « So clean, you can kiss it » Source : LLB Online Agency : Joan Berlin (Germany) |

Exclusive: Latest ‘Cashback Like a Pro’ ad uses Hartbeat production company and highlights Chase NBA and WNBA investment.

Car Insurance Cost for 1992 Chevrolet Suburban 2500: Affordable Rates From Top 3 Companies

The 1992 Chevrolet Suburban 2500 is a classic SUV that has garnered a loyal following over the years. Known for its durability and spaciousness, this vehicle continues to be a popular choice for families and outdoor enthusiasts. If you are a proud owner of a 1992 Chevrolet Suburban 2500, you may be wondering about the cost of insuring your beloved vehicle. In this article, we will explore the car insurance rates for this particular model from three top insurance companies and provide you with some cool facts about the car.

When it comes to insuring your 1992 Chevrolet Suburban 2500, it’s important to find the right coverage at an affordable rate. To help you with your decision, we have gathered information from three leading insurance companies: GEICO, State Farm, and Progressive. Please note that these rates are subject to change and may vary depending on several factors such as your location, driving history, and coverage preferences.

GEICO offers competitive rates for insuring a 1992 Chevrolet Suburban 2500. On average, their annual premium for this vehicle ranges from $800 to $1,200, depending on your coverage needs and location. GEICO is known for its excellent customer service and comprehensive coverage options, making it a popular choice among car owners.

State Farm is another reputable insurance company that offers affordable rates for the 1992 Chevrolet Suburban 2500. Their average annual premium for this model ranges from $900 to $1,300, depending on various factors. State Farm is known for its extensive network of agents, making it convenient for customers to access their services and get personalized assistance when needed.

Progressive is also a popular choice for insuring a 1992 Chevrolet Suburban 2500. Their average annual premium for this vehicle ranges from $850 to $1,400, depending on your location and coverage preferences. Progressive is known for its user-friendly online platform, making it easy for customers to manage their policies and claims.

Now, let’s delve into some cool facts about the 1992 Chevrolet Suburban 2500. This vehicle was part of the ninth generation of Suburbans, which were produced from 1992 to 1999. The 1992 model featured a robust V8 engine, capable of producing 190 horsepower. It boasted an impressive towing capacity of up to 10,000 pounds, making it an ideal choice for hauling heavy loads.

The 1992 Chevrolet Suburban 2500 also had a spacious interior, with seating for up to nine passengers. It offered ample cargo space, making it perfect for family trips or outdoor adventures. This model was renowned for its durability, and many owners reported driving their Suburbans for well over 200,000 miles.

In conclusion, insuring a 1992 Chevrolet Suburban 2500 can be affordable, especially when choosing from reputable insurance companies like GEICO, State Farm, and Progressive. The rates mentioned above are a general estimate, so it’s recommended to obtain personalized quotes based on your specific circumstances. With its ruggedness and spaciousness, the 1992 Chevrolet Suburban 2500 continues to be a beloved vehicle among car enthusiasts, providing both functionality and style.

IHOP rode with Dale Earnhardt Jr. in Amazon’s NASCAR debut as the Coca-Cola 600 fit the brand’s sports streaming strategy.

Car Insurance Cost for 1992 Chrysler Fifth Ave: Affordable Rates From Top 3 Companies

The cost of car insurance is an important consideration for any vehicle owner, and the 1992 Chrysler Fifth Ave is no exception. Known for its elegant design and powerful performance, this classic car still holds a special place in the hearts of many automobile enthusiasts. If you are a proud owner of a 1992 Chrysler Fifth Ave, it is essential to find the right car insurance coverage at an affordable rate. In this article, we will explore the top three companies offering competitive rates for insuring this particular vehicle, along with some cool facts about the car itself.

1. Geico:

Geico is a well-known insurance company that offers affordable rates for various vehicles, including the 1992 Chrysler Fifth Ave. For this classic car, Geico offers an annual premium rate of around $900. With their excellent customer service and user-friendly online tools, Geico is a popular choice for many car owners.

2. Progressive:

Progressive is another reputable insurance provider that caters to the needs of classic car owners. For the 1992 Chrysler Fifth Ave, Progressive offers an annual premium rate of approximately $1,000. With their customizable coverage options and a range of discounts, Progressive ensures that you get the right coverage at a competitive price.

3. State Farm:

State Farm is a trusted insurance company that has been serving customers for decades. They also provide coverage for the 1992 Chrysler Fifth Ave at an annual premium rate of around $1,200. State Farm offers various discounts, such as safe driver discounts and multi-policy discounts, which can help reduce the overall insurance cost.

Now, let’s delve into some cool facts about the 1992 Chrysler Fifth Ave:

1. Luxurious Interior: The 1992 Chrysler Fifth Ave boasted a luxurious interior with plush velour seating, genuine wood accents, and electronic instrument clusters. It was designed to provide a comfortable and elegant driving experience.

2. Powertrain: The vehicle came equipped with a 3.3-liter V6 engine, delivering a respectable 147 horsepower. This engine provided smooth acceleration and ample power for cruising on the highways.

3. Safety Features: The 1992 Chrysler Fifth Ave was equipped with anti-lock brakes (ABS) and driver-side airbags, which were relatively advanced safety features for that era.

4. Classic Design: The car showcased a classic design, featuring a large chrome grille, squared-off body lines, and a distinctive hood ornament. Its timeless appearance still turns heads on the roads today.

5. Longevity: The 1992 Chrysler Fifth Ave was known for its durability and longevity. Many enthusiasts still own and maintain these vehicles, thanks to their solid construction and reliable performance.

In conclusion, finding affordable car insurance for your 1992 Chrysler Fifth Ave is possible by considering the rates offered by Geico, Progressive, and State Farm. These companies provide competitive rates and excellent coverage options for this classic car. With its luxurious interior, powerful engine, and timeless design, the 1992 Chrysler Fifth Ave continues to captivate car enthusiasts around the world.