Smoking Hot Copycat / Un coup fumant?

Posted in: Uncategorized |

|

|

| THE ORIGINAL? Suzi Wan Hot Sauce – 2005 Source : Cannes Archive Agency : BBDO (Austria) |

LESS ORIGINAL Tabasco hot sauce – 2006 Source : Cannes Archive Agency : DDB Dallas (USA) |

LESS ORIGINAL Jong Hwa Restaurant « extra hot shrimps » – 2013 Source : Adsoftheworld Agency : BigBang Istanbul (Turkey) |

75 Surprising Scarves – From Vintage Wrap Wall Art to Punchy Geometric Shawls (TOPLIST)

Posted in: UncategorizedBandsaw Skyline Sculptures – The City Series by James McNabb is Intricately Urban (GALLERY)

Posted in: Uncategorized10 Jaw-Dropping Ombre Desserts – From Color-Fading DIY Pastries to Japanese Dishes (TOPLIST)

Posted in: UncategorizedThe Blind Spot at Davos

Posted in: UncategorizedThe “algos-gone-wild” culture of global finance.

From Adbusters #105: The Big Ideas of 2013

ETHAN COX

One of the stumbling blocks the World Economic Forum faces is its garish elitism. Oxfam announced that the world’s 100 wealthiest individuals earned enough money in 2012 to end poverty around the world four times over. Meanwhile, this same global elite is gathered at Davos for the annual meeting of the World Economic Forum (WEF). International hot shots arrive here on private jets to attend somber seminars on the fiscal cliff, climate change, and food security whilst nibbling away on decadent cheese and sipping expensive wine.

Although the lavish spending required to put on and attend the forum is hypocritical considering poverty, inequality and the economic crisis are the chief issues on the table, perhaps the real problem is not with “elitism” as such. The real issue is what Jem Bendell calls the “sycophancy of the elite.” This rampant sycophancy “restricts [their] ability to explore root causes [of the financial crisis] for that might challenge [WEF] members.”

Professor of Sustainability Leadership and Founding Director of the Institute for Leadership and Sustainability, Jem Bendell explains for Al Jazeera:

In 2008, as the financial crisis was in its first flush, the founder of the WEF, Klaus Schwab, effectively apologised for the Forum not having provided insight on the coming storm. “We let it get out of control, and attention was taken away from the speed and complexity of how the world’s challenges built up,” said Professor Schwab. I wondered at the time whether an institution that pays its bills by convening the world’s largest companies to entertain them at high-powered meetings would be beset by a form of systemic sycophancy, restricting its ability to explore any root causes that might challenge members. Five years into the crisis, with more scandals in the past year than ever, from libor to money laundering, we don’t see a major shift in approach at Davos. Banks participate in many of the Global Agenda Councils, and this year UBS co-chairs the Davos summit.

The question therefore formulating in my mind as I head to Davos this year is whether sufficient people in powerful institutions really understand how broken the current systems are, and if they are brave enough to look honestly at what it may take to change them.

For an honest look at the root causes of the Flash Crash, read more below from Darren Fleet, as featured in Adbusters Big Ideas of 2013:

. . .

A sum begets an action, which begets a reaction, which begets a sum, which begets an action, which begets a sum, which begets a reaction, which begets a sum. Before you know it, in less time than it takes to blink an eye, a billion equations have flashed across your stock floor computer screen.

You blink your eye again and the global economy, its products and the livelihoods of millions of people are in free-fall. Pension funds, retirement savings, college trusts, union investments, commodity gains, all wiped away by an out-of-control computer equation. The spark? A lone wolf billionaire or hedge fund manager dumping millions of units into a trading algorithm. Or maybe a faceless entity looking for quick kills in the shadow economy of Dark Pools and High Frequency Trading (HFT) – assets held for only millionths of a second before they’re traded again.

Ever since the Flash Crash of 2010, when an out-of-control financial algorithm cost the Dow nine percent of its worth in the span of a few hours, regulators across the world have been debating if, and how, they can rein HFT in. This has proven to be a difficult task. While this type of hyper-trading can go rogue beyond human control, it is also incredibly popular, accounting for an estimated 65 percent of all market transactions.

In the highly networked financial world, mathematical functions trigger exponential waves of buying and selling on a daily basis. This relinquishing of control to programs has ushered in an entire new realm of speculation, adding even greater layers of chaos to an already temperamental system. The appearance of ghost algorithms, “algos,” like the one that snaked through the US stock market in October 2012, making up 4 percent of all trades in one day, have left even experienced traders perplexed. They can’t tell if the algo is human-controlled, automatic, or one of a plethora of equations like “news-algos” that surf the web and translate headlines into stock probability within nanoseconds.

In Europe and Canada, small proposals have been made to combat the unpredictable dark side of HFT, like slowing the necessary time of asset ownership from a millionth of a second to five hundredths of a second, or placing small levies on mass trading of financial units. Some have even proposed a “kill switch,” a big red Off button that can be pushed when doomsday algorithms run wild, buying, selling and erasing mass quantities of human wealth and labor. What these kinds of suggestions have in common is that they do nothing to address the problem.

When the fundamental premise of trading is profit at any cost, when the rules are set up in such a way that the trader with the biggest super computer wins, it goes without saying that some aspect of basic human morality has been lost. Within the context of global financial anarchy, regulations in territories like Canada and the EU will only serve to drive HFT into greater concentration in unregulated markets in the US and Australia, and deeper into Dark Pools which, according to recent estimates, account for nearly 15 percent of global GDP – money with no identity buying and selling assets with no name. Real change will come when the basic premise of HFT is combatted head-on.

What the world needs isn’t another speed limit measured in abstracted nanoseconds. It needs speeds measured in human time, hours and days. A 24-hour stock ownershop rule, the only sure thing able to stop the algos-gone-wild culture, is a good place to start, followed by a Robin Hood tax on all speculative financial transactions.

What holds these reforms back is not the cost, not the understanding, not the sense of it, but a global culture of sheepishness. A basic lack of confidence. A culture that thinks it’s too stupid to understand the market. A culture that sees economists as scientists beyond reproof rather than as salesmen responsible for the products they sell. We need to turn off and tune out the paid-for financial pundits who say there is only one way to be. We need to uproot the internalized neoliberal, real estate agent and growth economist thinking embedded in the subconscious of our democracies.

In 2011 the global imagination erupted in a frenzy of possibility. Has it been so quickly sung back to sleep?

Now put this poster up

Cadaver, uma história de amor agridoce

Posted in: UncategorizedLaboratório de anatomia. Duas garotas recebem a missão de fazer a autópsia de um corpo. O primeiro órgão a ser retirado, o coração, prende a atenção de uma delas. Enquanto isso, o corpo retorna à vida (?!) e pede para ser levado ao encontro de seu grande amor. O que acontece a partir daí é uma história envolvente e muito bem executada no curta de animação Cadaver – A Bittersweet Love Story. Com roteiro e direção de Jonah D. Ansell, o filme tem participações ilustres de Christopher Lloyd, Kathy Bates e Tavi Gevinson.

O texto é todo rimado ou, como diz o site oficial, é “um soneto de amor do século 21 que busca despertar o mais esperançoso romântico dentro do pior cínico”.

Cadaver esteve entre os 56 curtas de animação qualificados para concorrer ao Oscar, mas não chegou aos 5 indicados que concorrem à estatueta. Além da animação, a obra de Jonah D. Ansell também será lançada no formato graphic novel ainda este ano. Imperdível.

Post originalmente publicado no Brainstorm #9

Post originalmente publicado no Brainstorm #9

Twitter | Facebook | Contato | Anuncie

35 Fashionable Rainwear Finds – From Translucent Couture Capes to Rainy Day Footwear (TOPLIST)

Posted in: UncategorizedTop 20 Trends of the Day – From Dead Christmas Tree Art to Futuristic Home Decor (TOPLIST)

Posted in: UncategorizedMessage to Davos

Posted in: UncategorizedHow about a new economic paradigm?

The global business elite have arrived in Davos, Switzerland for the annual World Economic Forum — a “global platform for global issues,” where politicians, economists, bankers, academics, and celebrities gather to deliberate solutions to the world’s problems, out of an avowed “committment to improving the state of the world.” Meanwhile, between the private helicopters and charter planes required to get there (and the carbon they emit), the WEF membership fees and lodging/meal costs once you arrive, a week at the WEF averages $40,000. This year’s theme is “resilient dynamism,” a philosophy that the WEF’s founder Klaus Schwab described as looking “at the future in a much more positive way.” Of course, while attendees speak eloquently about “economic dynamism” and “sustainable growth,” Davos is still operating within and perpetuating the very socio-economic paradigm that caused the mess we’re in in the first place.

Here’s a more heterodox way of looking at the problem: We calculate the hidden prices associated with products — what the economists nonchalantly refer to as externalities — and incorporate them . . . We create an across the board global market regime in which the price of every product tells the ecological truth!

Read more below about True Cost Economics from the recently released book Meme Wars – The Creative Destruction of Neoclassical Economics.

. . .

What is the real cost of ?shipping a container load of toys from Hong Kong to Los Angeles? Or a case of apples grown in New Zealand to markets in North America? And what is the true cost of that fridge humming 24/7 in your kitchen … that steak sizzling on your grill … that car sitting ?in your garage?

Practically every one of the products we buy in the ?global marketplace is grossly undervalued. This is primarily because the environmental and corresponding social costs haven’t been taken into account. Mass production drives per unit cost down well enough, but the cost of a sane and sustainable future is going up. Every one of the billions of purchases we make every day in the global marketplace pushes us a little deeper into the cosmic red.

But what if we were to implement this simple idea: True Cost.

We calculate the hidden price associated with products — what the economists nonchalantly refer to as externalities — and incorporate them. We force the cost of every product in the global marketplace to tell the ecological truth.

We start with the little things: Plastic bags, coffee cups, paper napkins. Economists calculate these eco costs — say it’s five cents per plastic bag, ten cents per cup and one cent per napkin — then we just tack that on. We’re already doing that with the various eco-fees and eco-taxes included in the price of tires, cans of paint and other products. But now we abandon the concept of ancillary fees and taxes and implement straight true-cost pricing.

Over a ten-year period, we phase in true-cost eating. We raise the price of avocados from Mexico and shrimp from China to reflect the true cost of transporting them long distances. And we estimate and add on all the hidden costs of our industrial farming and food processing systems. That burger at McDonald’s will cost you more — so will most meats, produce and processed foods. You can eat whatever you want, but you’ll have to pay the true cost. Inevitably, your palate will submit to your wallet. Processed, mega-farmed and imported foods become more expensive as the cost of organic and locally produced food goes down. Bit by bit, purchase by purchase, the global food system heaves toward sustainability.

Then we phase in the true cost of driving. We add on the environmental cost of the carbon our cars emit, the cost of building and maintaining roads, the medical costs of accidents, the noise and the aesthetic degradation caused by urban sprawl and maybe even the military cost of protecting those crucial oil fields and oil tanker supply lines. Your private automobile will cost you around $100,000 and a tank of gas $250. You’re still free to drive all you want, but instead of passing the costs on to future generations or innocent people halfway across the globe, you pay upfront.

This is not a world where only the über-rich enjoy the spoils of elite products — quite the opposite. With such little demand for inefficient and polluting transport, we’re forced to reinvent the way we get around. Demand for monorails, bullet trains, subways and streetcars would surge. We would demand more bike lanes and pedestrian paths and car-free urban centers. And gradually a paradigm shift in urban planning would transform urban life. Suddenly cities are built for people, not for automobiles. Parking lots disappear. Community gardens rise.

True-cost pricing is fraught with daunting, seemingly insurmountable problems. For conventional economists, it’s a frightening, heretical concept that would slow growth, reduce the flow of world trade and curb consumption. It’s so true that it must be false. It would force us to rethink just about every economic axiom we’ve taken for granted since the dawn of the industrial age. It could turn out to be one of the most traumatic economic/social/cultural projects that humanity has ever undertaken. And yet … and yet … the idea of a global marketplace in which the price of every product tells the ecological truth has a simple, almost magical ring to it.

It makes sense, it feels right and it’s totally nonpolitical. It’s the one big idea that — if we are able to agree on it, implement it and muster the collective self-discipline to sustain it — could pull us out of the ecological tailspin we’re in and nudge this failing experiment of ours on Planet Earth back onto the rails.

Read more on Adbusters.org

Listen to Help usa Spotify para ajudar entidade

Posted in: Uncategorized

Há alguns anos, a BBH mantém um programa de estágio bem bacana, o Barn BBH, que seleciona jovens talentos para seus escritórios ao redor do mundo. E foi a turma do Barn de Londres que botou em prática o Listen to Help, um projeto que soube explorar muito bem os serviços oferecidos pelo Spotify em nome do Sound Seekers.

A ideia é simples e eficiente: sempre que você ouve uma música utilizando o Spotify, o artista é pago. Usando esse raciocínio, os criativos do Barn gravaram uma faixa explicando o que era o Listen to Help e disponibilizaram no Spotify. Toda vez que a faixa é ouvida, o valor é doado para a Sound Seekers, uma entidade dedicada a ajudar deficientes auditivos de países em desenvolvimento – especialmente crianças – a ouvir novamente.

Quanto mais vezes a faixa for ouvida, mais fundos o projeto irá arrecadar.

Post originalmente publicado no Brainstorm #9

Post originalmente publicado no Brainstorm #9

Twitter | Facebook | Contato | Anuncie

50 Egg-Shaped Design Finds – From Energy-Saving Eco Eggs to Egg-Shaped Enclosures (TOPLIST)

Posted in: UncategorizedActivision apresenta um substituto da sua vida para você poder jogar “Call of Duty: Black Ops II”

Posted in: UncategorizedA indústria dos games é prolífica e criativa, mas também cruel. São tantos bons jogos, mas tão pouco tempo livre para jogar.

Sabendo disso, a Activision apresenta uma das profissões do futuro: O Substituto. Aqui representado pelo ator Peter Stormare, o profissional aparece em boa hora para ficar no seu lugar em tarefas importantes do dia a dia, como o nascimento do seu filho, jantar com a namorada, montagem de móveis, entre outras obrigações.

O filme promove “Revolution”, o primeiro DLC de “Call of Duty: Black Ops 2″, que será lançado em 29 de janeiro para Xbox 360.

A criação é da 72andSunny.

Post originalmente publicado no Brainstorm #9

Post originalmente publicado no Brainstorm #9

Twitter | Facebook | Contato | Anuncie

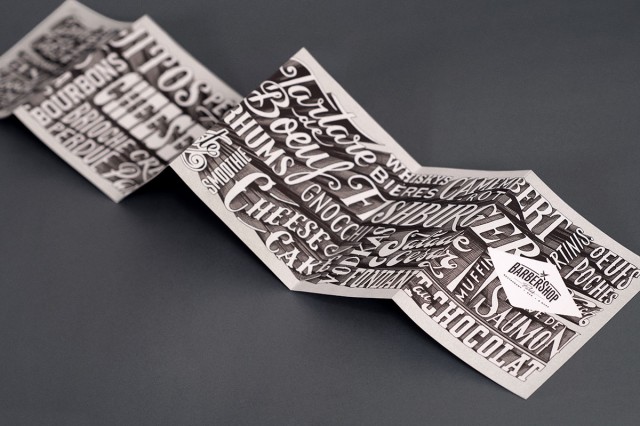

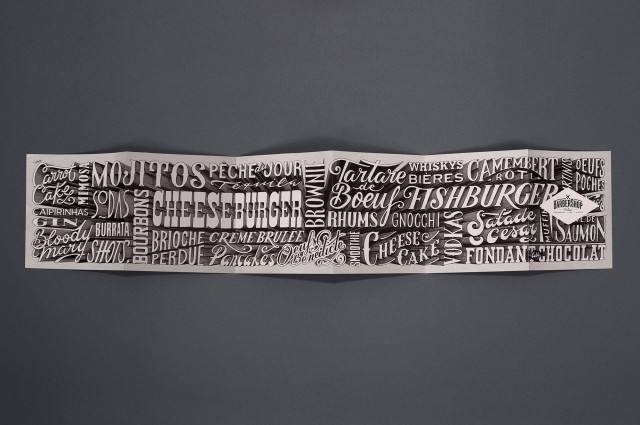

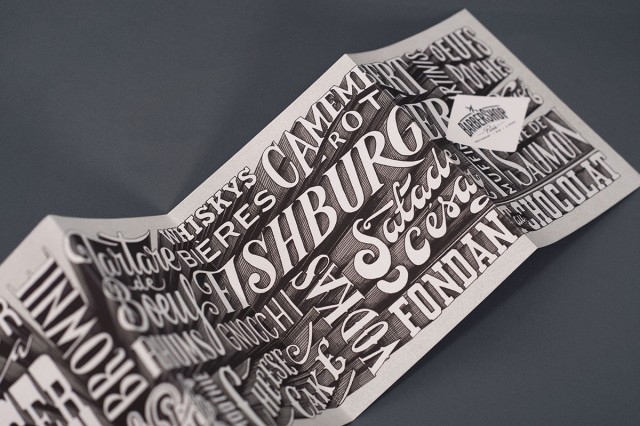

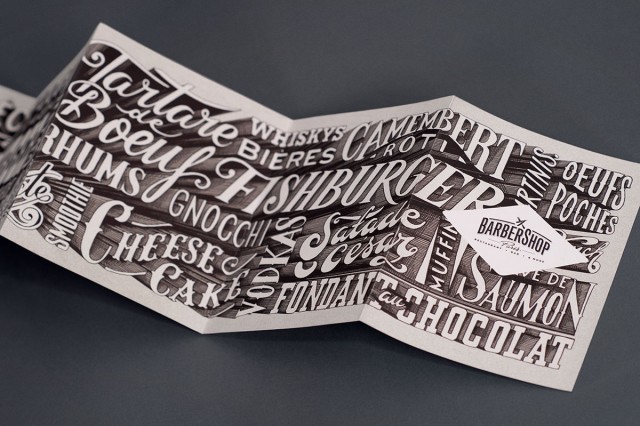

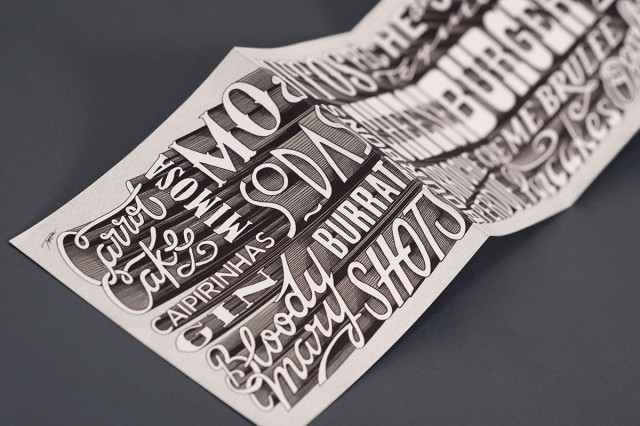

Barbershop Illustration

Posted in: UncategorizedFocus sur ce superbe menu imaginé par Tyrsa pour le restaurant parisien Barbershop. L’artiste, dont nous avons pu consacrer une interview pour Fubiz TV 11, a voulu rendre hommage à Herb Lubalin et le mur qu’il a crée dans la cantine de CBS en 1966 avec cette illustration de 82cm de long travaillée au Micron.

Air Drive Photography

Posted in: UncategorizedLe français Renaud Marion a imaginé cette superbe série d’images sobrement intiulée « Air Drive ». Volontairement rétro-futuriste afin de montrer comment le photographe imaginait les années 2000 dans son enfance, les clichés retouchés par Armand Mongallon sont à découvrir dans la suite de l’article.