Sonic Union to Present “Musical Bias and the Brief: A Workshop For The Storytelling Process in Original Film Composition” at Ciclope

Posted in: UncategorizedSocial Shopping Is on the Rise—and It’s Not Just Gen Z

Posted in: UncategorizedShoppers of all ages are buying products through social apps, gaming platforms, and livestreams, according to new data from Horizon Media, exclusively shared with ADWEEK. TikTok’s popularity among younger audiences, and the buzz around TikTok Shop, has spurred the notion that it’s Gen Zers who are most likely to shop via social platforms. According to…

Melania Trump Drops by Fox & Friends

Posted in: UncategorizedLast week, former President Donald Trump returned to the late night airwaves for the first time since 2016 with a taped appearance on the Fox News hit Gutfeld! Now, Melania Trump will make her own FNC pit stop in the early morning hours on the network’s AM staple, Fox & Friends. The former first lady…

Republicans Hope Anti-Trans Sentiment Boosts Voter Turnout

Posted in: UncategorizedThe Culture War is the war that never ends. One side is hell-bent on denying American citizens their rights to bodily autonomy, gender identity, even books, and a decent education. To this end, the National Republican Congressional Committee unveiled its first Texas ad of the general election last week, accusing U.S. Rep. Vicente Gonzalez, D-McAllen, […]

The post Republicans Hope Anti-Trans Sentiment Boosts Voter Turnout appeared first on Adpulp.

Donald Trump Rejects Kamala Harris Debate Rematch

Posted in: UncategorizedHere’s a sequel to a blockbuster that won’t be happening. On Saturday, Vice President Kamala Harris accepted an offer from CNN to headline a second presidential debate, scheduled for Oct. 23. Later that same day, though, former President Donald Trump appeared to reject the proposed rematch with his Democratic rival. Speaking at a North Carolina…

Sterling Riggs Leaving WDRB in Louisville

Posted in: UncategorizedWDRB morning anchor Sterling Riggs has announced his departure from the Louisville, Kentucky Fox affiliate. “Friday, September 27th will be my last day on WDRB Mornings,” he announced on social media. “Words can’t express what a wonderful ride it has been,” he wrote. “I will miss the team and our viewers tremendously.” Riggs, who joined…

Jonathan Novack Joining KIAH in Houston as Chief Meteorologist

Posted in: UncategorizedJonathan Novack is joining Houston CW affiliate KIAH as chief meteorologist. Novack comes from Los Angeles Fox-owned station KTTV. The move was first reported by Houston media blogger Mike McGuff. This is a return to Houston for Novack, who worked at NBC station KPRC from 2007 to 2010 before leaving to appear on The Bachelorette…

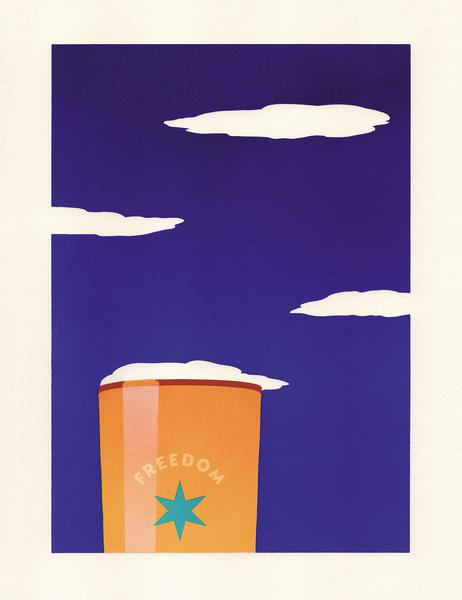

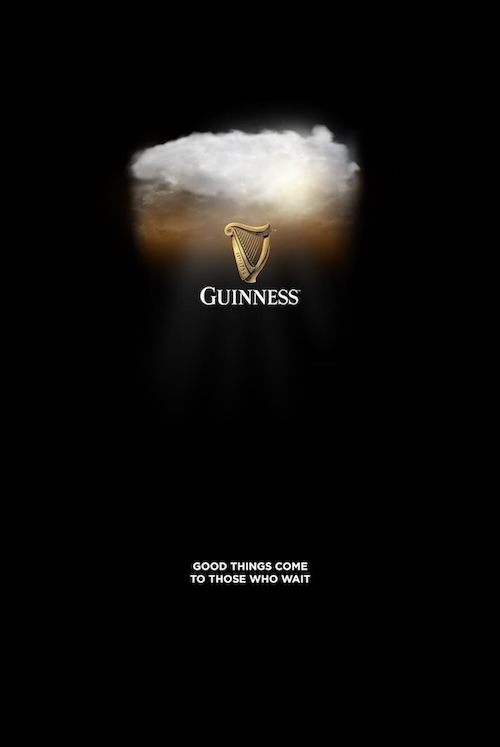

a beer foam light like a cloud / C’est l’originalité qui trinque!

Posted in: Uncategorized |

|

|

| THE ORIGINAL? Freedom Brewery – 2017 Source : D&AD Click image to enlarge Agency : CHI London (UK) |

LESS ORIGINAL Guinness Beer – 2020 Source : Ad Forum Click image to enlarge Agency : WingsCLL (UK) |

LESS ORIGINAL Patagonia Cerveza– 2024 Source : Love The Work / Cannes Lions Click image to enlarge Agency : Trans Co, Buenos Aires (Argentina) |

New York Magazine Suspends Olivia Nuzzi Following Alleged Affair With RFK Jr.

Posted in: UncategorizedThe East Coast media world was rocked by the news that political journalist Olivia Nuzzi had been suspended by New York magazine after an alleged affair with former 2024 presidential candidate Robert F. Kennedy Jr. Former CNN media reporter Oliver Darcy broke the news in his Status newsletter. (TVNewser) Nuzzi did not proactively disclose her…

The Tumult that Transformed Racquet, the Tennis Magazine

Posted in: UncategorizedThe indie magazine Racquet aims to become a major player in the business of tennis — after a messy dispute between its two founders.

The Tumult that Transformed Racquet, the Tennis Magazine

Posted in: UncategorizedThe indie magazine Racquet aims to become a major player in the business of tennis — after a messy dispute between its two founders.

The Tumult that Transformed Racquet, the Tennis Magazine

Posted in: UncategorizedThe indie magazine Racquet aims to become a major player in the business of tennis — after a messy dispute between its two founders.

Cheap SR22 Insurance in Alabama

Posted in: UncategorizedObtaining cheap car insurance in Alabama can be a daunting task, especially if you are required to have an SR22 filing. SR22 insurance is a special form of car insurance that is necessary for drivers who have been convicted of certain driving offenses, such as DUI or driving without insurance. In Alabama, SR22 insurance can be quite expensive, but there are ways to find affordable coverage if you are willing to put in the work.

One of the best ways to find cheap car insurance in Alabama is to compare quotes from different insurance providers. Here are four ways to compare quotes and why it’s important to put in the effort:

1. Agents or Brokers: One of the traditional ways to compare car insurance quotes is to work with an insurance agent or broker. Agents and brokers have access to multiple insurance companies and can help you find the best coverage at the lowest price. They can also provide personalized advice based on your specific needs and driving history.

2. National Carriers: Another option for comparing car insurance quotes is to contact national insurance carriers directly. Companies like Geico, Progressive, and State Farm offer online quote tools that allow you to compare rates from multiple providers in just a few minutes. This can be a convenient way to get a quick overview of the available options.

3. Online Comparison Sites: There are also online comparison sites that can help you compare car insurance quotes from multiple providers at once. Sites like Compare.com, The Zebra, and Insurify allow you to enter your information once and receive quotes from several different companies. This can save you time and make it easier to find affordable coverage.

4. Independent Research: Finally, you can also do your own research by contacting insurance companies directly and requesting quotes. This can be a time-consuming process, but it can also give you a more comprehensive view of the available options. By comparing quotes from multiple sources, you can ensure that you are getting the best possible deal on your car insurance.

When comparing car insurance quotes in Alabama, it’s important to consider several factors. These include the coverage limits, deductibles, and any additional benefits or discounts offered by the insurance provider. By taking the time to compare quotes from different sources, you can find the most affordable coverage that meets your needs.

To give you an idea of the costs associated with car insurance in Alabama, here are the average costs for six popular insurance companies in the state, broken down by age group:

1. State Farm

– Age 25-30: $800-$1,000 per year

– Age 30-40: $700-$900 per year

– Age 40-50: $600-$800 per year

2. Geico

– Age 25-30: $700-$900 per year

– Age 30-40: $600-$800 per year

– Age 40-50: $500-$700 per year

3. Progressive

– Age 25-30: $750-$950 per year

– Age 30-40: $650-$850 per year

– Age 40-50: $550-$750 per year

4. Allstate

– Age 25-30: $850-$1,050 per year

– Age 30-40: $750-$950 per year

– Age 40-50: $650-$850 per year

5. Nationwide

– Age 25-30: $800-$1,000 per year

– Age 30-40: $700-$900 per year

– Age 40-50: $600-$800 per year

6. Farmers

– Age 25-30: $900-$1,100 per year

– Age 30-40: $800-$1,000 per year

– Age 40-50: $700-$900 per year

These are just average costs and may vary based on factors such as your driving record, the make and model of your car, and the coverage limits you choose. By comparing quotes from multiple providers, you can find the best deal on car insurance in Alabama.

Here are 14 common questions about obtaining cheap car insurance in Alabama, along with their answers:

1. What is SR22 insurance and why is it necessary in Alabama?

SR22 insurance is a special form of car insurance that is required for drivers who have been convicted of certain driving offenses, such as DUI or driving without insurance. In Alabama, drivers who are required to have an SR22 filing must maintain this coverage for a specified period of time to prove financial responsibility.

2. How can I find affordable SR22 insurance in Alabama?

To find affordable SR22 insurance in Alabama, it’s important to compare quotes from multiple providers. You can work with an insurance agent or broker, contact national carriers directly, use online comparison sites, or do your own research to find the best deal.

3. What factors affect the cost of car insurance in Alabama?

Several factors can affect the cost of car insurance in Alabama, including your driving record, the make and model of your car, your age, and the coverage limits you choose. By maintaining a clean driving record and shopping around for quotes, you can find affordable coverage.

4. Are there any discounts available for car insurance in Alabama?

Many insurance companies offer discounts for factors such as safe driving, multiple policies, and bundling coverage. By taking advantage of these discounts, you can lower the cost of your car insurance in Alabama.

5. What is the minimum car insurance coverage required in Alabama?

In Alabama, drivers are required to have liability insurance with minimum coverage limits of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. Additional coverage options are available for drivers who want more protection.

6. Can I get car insurance without a driver’s license in Alabama?

In Alabama, you must have a valid driver’s license to purchase car insurance. If you do not have a driver’s license, you may be able to purchase a non-owner car insurance policy, which provides liability coverage when you drive someone else’s car.

7. Is it possible to get cheap car insurance for young drivers in Alabama?

Young drivers in Alabama typically pay higher insurance rates due to their lack of driving experience. However, there are ways to lower the cost of car insurance for young drivers, such as taking a defensive driving course, maintaining good grades, and driving a safe car.

8. Can I get car insurance with a DUI on my record in Alabama?

If you have a DUI on your record in Alabama, you may be required to have SR22 insurance and may face higher insurance rates. By comparing quotes from multiple providers and maintaining a clean driving record, you can find affordable coverage even with a DUI on your record.

9. How can I lower the cost of car insurance in Alabama?

There are several ways to lower the cost of car insurance in Alabama, such as maintaining a clean driving record, choosing a safe car, taking advantage of discounts, and comparing quotes from multiple providers. By being a responsible driver and shopping around for coverage, you can find affordable insurance.

10. What is the difference between full coverage and liability-only car insurance in Alabama?

Full coverage car insurance in Alabama includes liability, collision, and comprehensive coverage, which provides protection for your car in the event of an accident, theft, or damage. Liability-only insurance covers damages to other vehicles and property but does not cover your own car.

11. Can I cancel my car insurance policy at any time in Alabama?

In Alabama, you can cancel your car insurance policy at any time, but you may be subject to a cancellation fee or penalty. It’s important to review your policy terms and conditions before canceling to avoid any additional costs.

12. Do I need uninsured motorist coverage in Alabama?

Uninsured motorist coverage is not required in Alabama, but it can provide additional protection in the event that you are involved in an accident with a driver who does not have insurance. This coverage can help cover medical expenses and property damage.

13. How can I file a claim with my car insurance company in Alabama?

If you need to file a claim with your car insurance company in Alabama, you can contact your insurance agent or carrier directly. They will guide you through the claims process and help you get the compensation you need to repair your car or cover medical expenses.

14. What happens if I let my car insurance lapse in Alabama?

If you let your car insurance lapse in Alabama, you may face fines, license suspension, and other penalties. It’s important to maintain continuous coverage to comply with state laws and protect yourself in the event of an accident.

In conclusion, obtaining cheap car insurance in Alabama, especially with an SR22 filing, requires time and effort. By comparing quotes from different providers, considering factors that affect costs, and asking the right questions, you can find affordable coverage that meets your needs. Remember to shop around, take advantage of discounts, and maintain a clean driving record to lower the cost of car insurance in Alabama. With the right approach, you can find the best deal on car insurance and drive with peace of mind.

[ad_2]

Hasan Minhaj Spills the Tea On Why His Big Kolkata Chai Co. Investment Is Personal

Posted in: UncategorizedHasan Minhaj didn’t necessarily plan to add investor to his already burgeoning resume. Instead, the opportunity presented itself in a cup of smooth, spicy chai. Nine months after his first sip of the Kolkata Chai Co.’s signature blend, the Daily Show alumni has gone from a devoted customer to the brand’s second-largest stakeholder and business…

Cheap Auto Insurance Quotes in Berthold ND

Posted in: UncategorizedObtaining cheap car insurance can be a challenge, especially in a city like Berthold, North Dakota. However, with the right research and knowledge, you can find affordable insurance options that fit your budget. In this article, we will discuss the average insurance costs for the 9 most popular vehicle makes and models in Berthold, compare the pros and cons of 4 different insurance companies commonly used in this locale, and answer 13 common questions related to car insurance.

Average Insurance Costs for Popular Vehicle Makes and Models in Berthold, ND

When it comes to car insurance costs, several factors come into play, including the make and model of your vehicle. In Berthold, North Dakota, the average insurance costs for the 9 most popular vehicle makes and models are as follows:

1. Ford F-150: The average insurance cost for a Ford F-150 in Berthold is around $1,200 per year.

2. Chevrolet Silverado: The average insurance cost for a Chevrolet Silverado is approximately $1,150 per year.

3. Dodge Ram 1500: The average insurance cost for a Dodge Ram 1500 is around $1,300 per year.

4. Toyota Camry: The average insurance cost for a Toyota Camry is approximately $1,000 per year.

5. Honda Civic: The average insurance cost for a Honda Civic is around $950 per year.

6. Ford Escape: The average insurance cost for a Ford Escape is approximately $1,100 per year.

7. Chevrolet Equinox: The average insurance cost for a Chevrolet Equinox is around $1,050 per year.

8. Toyota RAV4: The average insurance cost for a Toyota RAV4 is approximately $1,050 per year.

9. Jeep Wrangler: The average insurance cost for a Jeep Wrangler is around $1,400 per year.

These average insurance costs are based on a variety of factors, including the vehicle’s safety features, the driver’s age and driving record, and the insurance company’s policies. It’s important to shop around and compare quotes from different insurance companies to find the best rates for your specific vehicle.

Comparing Insurance Companies in Berthold, ND

In Berthold, North Dakota, there are several insurance companies that are commonly used by residents. Here, we will compare the pros and cons of 4 different insurance companies to help you make an informed decision when choosing your car insurance provider.

1. State Farm Insurance

Pros:

– State Farm offers a wide range of coverage options, including liability, collision, and comprehensive coverage.

– They have a strong financial stability rating, which means they are likely to pay out claims promptly.

– State Farm has a network of agents in Berthold, making it easy to get personalized service and support.

Cons:

– State Farm’s rates may be higher than some other insurance companies in the area.

– Some customers have reported issues with claims processing and customer service.

2. Allstate Insurance

Pros:

– Allstate offers a variety of discounts, including safe driver discounts and multi-policy discounts.

– They have a user-friendly website and mobile app, making it easy to manage your policy online.

– Allstate has a strong reputation for customer service and claims handling.

Cons:

– Allstate’s rates may be higher than other insurance companies in Berthold.

– Some customers have reported difficulty reaching customer service representatives by phone.

3. Progressive Insurance

Pros:

– Progressive offers a variety of coverage options, including usage-based insurance and roadside assistance.

– They have a user-friendly website with helpful tools and resources for policyholders.

– Progressive is known for their competitive rates and discounts for safe drivers.

Cons:

– Some customers have reported issues with claims processing and delays in payouts.

– Progressive may not have as many local agents in Berthold as other insurance companies.

4. Farmers Insurance

Pros:

– Farmers Insurance offers a variety of coverage options, including liability, collision, and comprehensive coverage.

– They have a network of local agents in Berthold who can provide personalized service and support.

– Farmers Insurance is known for their competitive rates and discounts for safe drivers.

Cons:

– Some customers have reported issues with claims processing and delays in payouts.

– Farmers Insurance may not offer as many discounts as other insurance companies in the area.

When choosing an insurance company in Berthold, it’s important to consider factors such as coverage options, rates, customer service, and financial stability. Be sure to compare quotes from multiple companies to find the best insurance policy for your needs.

13 Common Questions About Car Insurance

1. What factors affect car insurance rates in Berthold, ND?

– Several factors can affect car insurance rates in Berthold, including the driver’s age, driving record, type of vehicle, coverage options, and the insurance company’s policies.

2. How can I lower my car insurance rates in Berthold?

– To lower your car insurance rates in Berthold, you can take steps such as maintaining a clean driving record, bundling your policies, choosing a higher deductible, and taking advantage of discounts offered by insurance companies.

3. What is the minimum car insurance coverage required in North Dakota?

– In North Dakota, drivers are required to carry liability insurance with minimum coverage limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage.

4. Does my credit score affect my car insurance rates in Berthold?

– In North Dakota, insurance companies are allowed to use credit scores as a factor in determining car insurance rates. Having a higher credit score can help lower your insurance premiums.

5. Are there any discounts available for teen drivers in Berthold?

– Some insurance companies offer discounts for teen drivers who complete driver education courses, maintain good grades, or participate in safe driving programs.

6. Can I get car insurance without a driver’s license in Berthold?

– In North Dakota, you can purchase car insurance without a driver’s license, but you may need to provide a valid ID and have someone listed as the primary driver on the policy.

7. What should I do if I’m involved in a car accident in Berthold?

– If you’re involved in a car accident in Berthold, you should first make sure everyone is safe and call 911 if needed. You should also exchange insurance information with the other driver and file a claim with your insurance company.

8. How long do car insurance claims take to process in Berthold?

– The time it takes to process a car insurance claim in Berthold can vary depending on the complexity of the claim and the insurance company’s policies. In general, claims are typically processed within a few days to a few weeks.

9. Can I cancel my car insurance policy in Berthold at any time?

– In North Dakota, you can cancel your car insurance policy at any time, but you may be subject to a cancellation fee or penalty. It’s important to check with your insurance company to understand their cancellation policies.

10. What happens if I drive without car insurance in Berthold?

– Driving without car insurance in North Dakota is illegal and can result in fines, license suspension, and even vehicle impoundment. It’s important to maintain the required minimum insurance coverage at all times.

11. Can I insure a classic car in Berthold?

– Yes, you can insure a classic car in Berthold with specialized classic car insurance policies that offer coverage for the unique needs of vintage vehicles.

12. Are there any insurance options for high-risk drivers in Berthold?

– Some insurance companies in Berthold offer non-standard insurance policies for high-risk drivers who may have a poor driving record or multiple accidents on their record.

13. How can I find cheap car insurance in Berthold?

– To find cheap car insurance in Berthold, you can compare quotes from multiple insurance companies, take advantage of discounts, maintain a clean driving record, and choose a higher deductible to lower your premiums.

In conclusion, obtaining cheap car insurance in Berthold, North Dakota is possible with the right research and knowledge. By comparing insurance companies, understanding the factors that affect insurance rates, and asking the right questions, you can find affordable coverage that meets your needs and budget. Remember to shop around, compare quotes, and consider factors such as coverage options, rates, customer service, and financial stability when choosing an insurance provider.

[ad_2]

Cheap SR22 Insurance in Alaska

Posted in: UncategorizedWhen it comes to obtaining cheap car insurance in Alaska, there are several factors to consider. One of the most important factors is comparing quotes from different insurance providers to find the best deal. There are several ways to do this, including working with agents or brokers, contacting national carriers directly, or using online comparison sites. Putting in the work to compare quotes can save you hundreds of dollars each year on car insurance premiums.

1. Working with Agents or Brokers: One way to compare quotes for car insurance in Alaska is to work with an insurance agent or broker. These professionals have access to a wide range of insurance providers and can help you find the best coverage at the best price. They can also provide you with valuable advice on the right amount of coverage for your needs.

2. Contacting National Carriers: Another option is to contact national insurance carriers directly. Many of these companies offer online quote tools that allow you to easily compare prices and coverage options. By contacting multiple carriers, you can get a better sense of what is available in the market and make an informed decision.

3. Using Online Comparison Sites: Online comparison sites are another great tool for finding cheap car insurance in Alaska. These sites allow you to input your information once and receive quotes from multiple insurance providers. This can save you time and effort in comparing prices and coverage options.

4. Putting in the Work: It’s important to put in the work to compare quotes from different insurance providers. While it may take some time and effort, the savings can be significant. By comparing quotes, you can find the best coverage at the best price and ensure that you are getting the most value for your money.

Now let’s take a look at the average costs of car insurance in Alaska for six popular insurance companies, broken down by age group:

1. GEICO:

– Age 20-29: $1,200

– Age 30-39: $1,000

– Age 40-49: $900

– Age 50-59: $800

– Age 60-69: $700

2. State Farm:

– Age 20-29: $1,300

– Age 30-39: $1,100

– Age 40-49: $1,000

– Age 50-59: $900

– Age 60-69: $800

3. Allstate:

– Age 20-29: $1,400

– Age 30-39: $1,200

– Age 40-49: $1,100

– Age 50-59: $1,000

– Age 60-69: $900

4. Progressive:

– Age 20-29: $1,100

– Age 30-39: $900

– Age 40-49: $800

– Age 50-59: $700

– Age 60-69: $600

5. USAA:

– Age 20-29: $1,000

– Age 30-39: $800

– Age 40-49: $700

– Age 50-59: $600

– Age 60-69: $500

6. Farmers:

– Age 20-29: $1,500

– Age 30-39: $1,300

– Age 40-49: $1,200

– Age 50-59: $1,100

– Age 60-69: $1,000

As you can see, the cost of car insurance in Alaska can vary significantly depending on your age and the insurance company you choose. By comparing quotes from different providers, you can find the best deal for your specific situation.

Finally, here are 14 common questions about obtaining cheap car insurance in Alaska, along with their answers:

1. Is car insurance required in Alaska?

Yes, car insurance is required in Alaska. The minimum coverage requirements include liability insurance, uninsured motorist coverage, and underinsured motorist coverage.

2. What factors affect the cost of car insurance in Alaska?

Several factors can affect the cost of car insurance in Alaska, including your age, driving record, location, the type of car you drive, and the amount of coverage you need.

3. How can I lower my car insurance premiums in Alaska?

There are several ways to lower your car insurance premiums in Alaska, including taking a defensive driving course, bundling your policies, raising your deductible, and maintaining a good credit score.

4. What is an SR22 filing and how does it affect car insurance rates in Alaska?

An SR22 filing is a certificate of financial responsibility that proves you have the minimum required car insurance coverage. If you are required to file an SR22, your car insurance rates may be higher.

5. Can I get cheap car insurance in Alaska with a bad driving record?

It may be more difficult to find cheap car insurance in Alaska with a bad driving record, but it is still possible. By comparing quotes from different providers, you can find the best deal for your situation.

6. What is the best way to compare car insurance quotes in Alaska?

The best way to compare car insurance quotes in Alaska is to contact multiple insurance providers directly or use online comparison sites to get quotes from different companies.

7. Are there discounts available for car insurance in Alaska?

Yes, many insurance companies offer discounts for things like bundling your policies, taking a defensive driving course, and maintaining a good driving record.

8. What is the average cost of car insurance in Alaska?

The average cost of car insurance in Alaska varies depending on your age, driving record, location, and the insurance company you choose. On average, car insurance in Alaska costs around $1,200 per year.

9. Can I get cheap car insurance in Alaska if I drive an older car?

Yes, you can still get cheap car insurance in Alaska if you drive an older car. By comparing quotes from different providers, you can find the best deal for your specific situation.

10. Do I need full coverage car insurance in Alaska?

Full coverage car insurance is not required in Alaska, but it is recommended for additional protection. You can choose the amount of coverage that best suits your needs and budget.

11. How can I find the best car insurance provider in Alaska?

To find the best car insurance provider in Alaska, it’s important to compare quotes from different companies, read customer reviews, and consider the level of customer service and claims satisfaction.

12. Can I get a discount on car insurance in Alaska for being a safe driver?

Yes, many insurance companies offer discounts for safe drivers. By maintaining a good driving record and taking a defensive driving course, you may be eligible for lower premiums.

13. What is the minimum liability coverage required for car insurance in Alaska?

The minimum liability coverage required for car insurance in Alaska is $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $25,000 for property damage.

14. How can I save money on car insurance in Alaska?

To save money on car insurance in Alaska, consider bundling your policies, raising your deductible, maintaining a good credit score, and taking advantage of discounts offered by insurance companies.

In conclusion, obtaining cheap car insurance in Alaska requires comparing quotes from different providers, considering various factors that affect the cost of insurance, and taking advantage of discounts and savings opportunities. By putting in the work to compare quotes and find the best deal, you can save money on car insurance premiums and ensure that you have the coverage you need at a price you can afford.

[ad_2]

Cheap SR22 Insurance in Arizona

Posted in: UncategorizedObtaining cheap SR22 car insurance in Arizona can be a daunting task, but with the right approach, it is possible to find affordable coverage. SR22 insurance is a form of car insurance that is required for drivers who have been convicted of certain driving offenses, such as DUIs or reckless driving. This type of insurance is often more expensive than traditional car insurance, but there are ways to save money and find the best rates.

One of the most important steps in finding cheap SR22 car insurance in Arizona is to compare quotes from different insurance providers. There are several ways to do this, including working with agents or brokers, contacting national carriers directly, or using online comparison sites. Each method has its own advantages and drawbacks, so it’s important to put in the work to find the best option for your individual needs.

Working with agents or brokers can be a good way to get personalized service and advice on finding the right insurance coverage for your situation. Agents and brokers can help you navigate the complexities of SR22 insurance and find the best rates from a variety of providers. They can also help you understand the coverage options available and make sure you are getting the best deal possible.

Another option is to contact national carriers directly to get quotes for SR22 insurance. National carriers often have a wide range of coverage options and can offer competitive rates for drivers who need SR22 insurance. While this method can be more time-consuming than working with an agent or broker, it can be a good way to compare rates from some of the largest insurance providers in the country.

Online comparison sites are another popular option for finding cheap SR22 insurance in Arizona. These sites allow you to compare rates from multiple insurance providers quickly and easily, making it simple to find the best deal for your individual needs. However, it’s important to be cautious when using online comparison sites, as some may not provide accurate or up-to-date information. It’s a good idea to double-check any quotes you receive from these sites before making a final decision.

When comparing quotes for SR22 insurance, it’s important to consider more than just the cost of the policy. You should also look at the coverage options, deductibles, and any additional fees or discounts that may apply. By taking the time to compare quotes from different providers, you can ensure that you are getting the best possible deal on your SR22 insurance coverage.

In Arizona, the cost of SR22 insurance can vary significantly depending on the insurance provider and the driver’s individual circumstances. To give you an idea of what to expect, here are the average costs of SR22 insurance for six popular insurance companies in Arizona, broken down by age group:

– For drivers under 25 years old, the average cost of SR22 insurance with State Farm is around $1,500 per year.

– For drivers between 25 and 35 years old, the average cost of SR22 insurance with GEICO is around $1,200 per year.

– For drivers between 35 and 45 years old, the average cost of SR22 insurance with Progressive is around $1,000 per year.

– For drivers between 45 and 55 years old, the average cost of SR22 insurance with Allstate is around $800 per year.

– For drivers between 55 and 65 years old, the average cost of SR22 insurance with Farmers is around $700 per year.

– For drivers over 65 years old, the average cost of SR22 insurance with USAA is around $600 per year.

Please note that these are just averages and actual costs may vary depending on your individual circumstances, such as your driving record, the type of car you drive, and where you live in Arizona. It’s always best to get personalized quotes from insurance providers to get an accurate estimate of how much SR22 insurance will cost you.

When it comes to finding cheap SR22 insurance in Arizona, there are a few common questions that drivers often have. Here are 14 of the most frequently asked questions about SR22 insurance, along with their answers:

1. What is SR22 insurance?

SR22 insurance is a form of car insurance that is required for drivers who have been convicted of certain driving offenses, such as DUIs or reckless driving. It is often more expensive than traditional car insurance because it is considered high-risk coverage.

2. How long do I need to have SR22 insurance?

The length of time you need to have SR22 insurance varies depending on the offense you were convicted of. In Arizona, most drivers need to have SR22 insurance for at least three years.

3. How can I get SR22 insurance in Arizona?

You can get SR22 insurance in Arizona by contacting an insurance provider that offers this type of coverage. You will need to provide proof of insurance to the Arizona Department of Transportation to have your license reinstated.

4. How much does SR22 insurance cost in Arizona?

The cost of SR22 insurance in Arizona varies depending on the insurance provider and your individual circumstances. On average, drivers can expect to pay between $500 and $1,500 per year for SR22 insurance in Arizona.

5. Can I get SR22 insurance if I don’t own a car?

Yes, you can still get SR22 insurance in Arizona even if you don’t own a car. Non-owner SR22 insurance is available for drivers who need to maintain coverage but don’t own a vehicle.

6. Will my insurance rates go down after I no longer need SR22 insurance?

Once you no longer need SR22 insurance in Arizona, your insurance rates may go down. However, this will depend on your individual circumstances, such as your driving record and the insurance provider you choose.

7. Can I switch insurance providers while I have SR22 insurance?

Yes, you can switch insurance providers while you have SR22 insurance in Arizona. However, it’s important to make sure that your new provider offers SR22 insurance and that you don’t have any gaps in coverage.

8. What happens if I let my SR22 insurance lapse?

If you let your SR22 insurance lapse in Arizona, your license may be suspended and you could face additional penalties. It’s important to maintain continuous coverage to avoid any issues with the Arizona Department of Transportation.

9. Can I remove the SR22 requirement from my insurance policy?

Once you are no longer required to have SR22 insurance in Arizona, you can request to have the requirement removed from your policy. Your insurance provider will need to submit a form to the Arizona Department of Transportation to have the SR22 requirement removed.

10. What happens if I move to another state while I have SR22 insurance?

If you move to another state while you have SR22 insurance in Arizona, you will need to comply with the laws of the new state. This may include transferring your SR22 insurance to the new state or obtaining a new SR22 policy.

11. Can I get SR22 insurance if I have a suspended license?

Yes, you can still get SR22 insurance in Arizona even if your license is currently suspended. SR22 insurance is often required to have your license reinstated after a suspension.

12. Can I get SR22 insurance if I have multiple driving offenses?

Yes, you can still get SR22 insurance in Arizona if you have multiple driving offenses on your record. However, you may face higher rates and more limited coverage options due to your driving history.

13. Do all insurance providers offer SR22 insurance?

Not all insurance providers offer SR22 insurance in Arizona. It’s important to contact insurance providers directly to find out if they offer this type of coverage and what their rates are.

14. How can I save money on SR22 insurance in Arizona?

To save money on SR22 insurance in Arizona, it’s important to compare quotes from multiple insurance providers and take advantage of any discounts or savings opportunities that may be available. You can also consider raising your deductibles or reducing your coverage limits to lower your premiums. By putting in the work to find the best rates, you can obtain cheap SR22 insurance in Arizona and stay on the road legally.

[ad_2]

Virgin Active Asks People to “Leave the Cult and Join the Club”

Posted in: UncategorizedToxicity is at an all-time high, according to unnamed experts. There’s toxicity in the workplace, toxicity online, and toxicity in the air. Toxicity has even seeped into entire industries. As a result, Virgin Active, a chain of health clubs in the U.K and beyond, is calling on people to rebel against the toxicity of the […]

The post Virgin Active Asks People to “Leave the Cult and Join the Club” appeared first on Adpulp.

Cheap SR22 Insurance in Arkansas

Posted in: UncategorizedObtaining cheap SR22 car insurance in Arkansas can be a daunting task, especially if you have a history of traffic violations or accidents. SR22 insurance is a form of financial responsibility that is required by the state for drivers who have been convicted of certain driving offenses. It can be expensive, but with some diligence and research, you can find affordable options.

One of the most important steps in finding cheap SR22 car insurance is to compare quotes from different insurance providers. There are several ways to do this, including working with agents or brokers, contacting national carriers directly, or using online comparison sites. Each method has its own advantages and disadvantages, but putting in the effort to compare quotes can save you hundreds of dollars in the long run.

Working with agents or brokers can be helpful because they have access to multiple insurance providers and can help you find the best rates. They can also provide personalized advice based on your individual needs and driving history. However, keep in mind that agents and brokers may charge a fee for their services, so be sure to ask about any additional costs upfront.

Contacting national carriers directly is another option for finding cheap SR22 car insurance. Many insurance companies offer online quotes or have toll-free numbers where you can speak with a representative. This can be a convenient way to get quotes quickly, but keep in mind that not all national carriers offer SR22 insurance, so you may need to contact multiple companies to find the best rates.

Using online comparison sites is perhaps the easiest and most efficient way to compare quotes for SR22 car insurance. These sites allow you to input your information once and receive multiple quotes from different insurance providers. This can save you time and effort, as you can easily compare rates and coverage options side by side. However, keep in mind that not all online comparison sites are created equal, so be sure to use reputable sites that are licensed to sell insurance in Arkansas.

Regardless of the method you choose, it’s important to put in the work to compare quotes from multiple insurance providers. Rates can vary widely between companies, so taking the time to shop around can help you find the best deal. Additionally, be sure to provide accurate and up-to-date information when requesting quotes, as this will ensure that you receive the most accurate rates possible.

In Arkansas, there are several popular insurance companies that offer SR22 car insurance. The cost of SR22 insurance can vary depending on factors such as age, driving history, and the insurance provider. To give you an idea of what to expect, here are the average costs for SR22 insurance from six different insurance companies in Arkansas, broken down by age group:

1. State Farm:

– Age 25-35: $500-$700 per year

– Age 36-50: $400-$600 per year

– Age 51-65: $300-$500 per year

2. Progressive:

– Age 25-35: $600-$800 per year

– Age 36-50: $500-$700 per year

– Age 51-65: $400-$600 per year

3. GEICO:

– Age 25-35: $550-$750 per year

– Age 36-50: $450-$650 per year

– Age 51-65: $350-$550 per year

4. Allstate:

– Age 25-35: $650-$850 per year

– Age 36-50: $550-$750 per year

– Age 51-65: $450-$650 per year

5. Farmers:

– Age 25-35: $700-$900 per year

– Age 36-50: $600-$800 per year

– Age 51-65: $500-$700 per year

6. Nationwide:

– Age 25-35: $750-$950 per year

– Age 36-50: $650-$850 per year

– Age 51-65: $550-$750 per year

Keep in mind that these are just average costs and your actual rates may vary based on your individual circumstances. Factors such as your driving record, credit score, and the type of vehicle you drive can all impact the cost of SR22 insurance. Additionally, some insurance companies may offer discounts for things like bundling policies or completing a defensive driving course.

In addition to comparing quotes and costs, it’s important to ask questions and fully understand your SR22 insurance policy. Here are 14 common questions about SR22 car insurance in Arkansas, along with answers to help you navigate the process:

1. What is SR22 insurance?

SR22 insurance is a form of financial responsibility that is required by the state for drivers who have been convicted of certain driving offenses, such as DUIs or driving without insurance. It certifies that you have the minimum amount of liability coverage required by law.

2. How long do I need SR22 insurance?

The length of time you are required to carry SR22 insurance can vary depending on the offense. In Arkansas, you may be required to carry SR22 insurance for 3-5 years, depending on the nature of the violation.

3. How much does SR22 insurance cost?

The cost of SR22 insurance can vary depending on factors such as age, driving history, and the insurance provider. On average, you can expect to pay anywhere from $300 to $900 per year for SR22 insurance in Arkansas.

4. Can I get SR22 insurance if I don’t own a car?

Yes, you can still get SR22 insurance even if you don’t own a car. Non-owner SR22 insurance provides liability coverage when you drive someone else’s car. This can be a good option if you frequently borrow or rent vehicles.

5. Do all insurance companies offer SR22 insurance?

Not all insurance companies offer SR22 insurance, so you may need to contact multiple companies to find one that does. Additionally, some insurance companies may charge higher rates for SR22 insurance, so be sure to compare quotes from different providers.

6. Will SR22 insurance affect my credit score?

No, SR22 insurance itself will not directly impact your credit score. However, if you fail to pay your premiums or have your policy canceled due to non-payment, this could negatively affect your credit.

7. Can I cancel my SR22 insurance once I no longer need it?

You can cancel your SR22 insurance once you are no longer required to carry it by the state. However, it’s important to follow the proper steps to avoid any penalties or fines. Be sure to contact your insurance provider and the Arkansas Department of Motor Vehicles to notify them of the change.

8. Can I switch insurance companies while carrying SR22 insurance?

Yes, you can switch insurance companies while carrying SR22 insurance. However, it’s important to notify your current insurance provider and the Arkansas Department of Motor Vehicles to avoid any lapses in coverage. Be sure to also compare quotes from different insurance companies to ensure you are getting the best rates.

9. Will SR22 insurance cover me if I drive someone else’s car?

SR22 insurance typically provides liability coverage for the driver, regardless of the vehicle they are driving. However, it’s important to check with your insurance provider to see if you need additional coverage for non-owned vehicles.

10. Can I get SR22 insurance if I have a suspended license?

Yes, you can still get SR22 insurance if you have a suspended license. In fact, SR22 insurance is often required as part of the process to reinstate your license. Be sure to follow the necessary steps outlined by the Arkansas Department of Motor Vehicles to get your license reinstated.

11. What happens if I let my SR22 insurance lapse?

If you let your SR22 insurance lapse, your insurance provider is required to notify the Arkansas Department of Motor Vehicles. This could result in fines, license suspension, or other penalties. It’s important to stay current on your SR22 insurance to avoid any issues.

12. Can I get SR22 insurance online?

Yes, many insurance companies offer the option to purchase SR22 insurance online. This can be a convenient way to get coverage quickly and easily. Be sure to provide accurate information when filling out the online application to receive the most accurate rates.

13. What is the difference between SR22 and SR21 insurance?

SR22 insurance is a form of financial responsibility that is required for drivers who have been convicted of certain driving offenses. SR21 insurance, on the other hand, is a form that is used to verify insurance coverage for drivers who have been involved in accidents or other incidents. The two forms serve different purposes and are not interchangeable.

14. How can I lower the cost of my SR22 insurance?

There are several ways to lower the cost of your SR22 insurance. You can try to improve your driving record, maintain a good credit score, or take advantage of discounts offered by insurance companies. Additionally, comparing quotes from different providers can help you find the best rates.

In conclusion, obtaining cheap SR22 car insurance in Arkansas may require some effort and research, but it is possible to find affordable options. By comparing quotes from different insurance providers, understanding the costs and coverage options, and asking the right questions, you can make informed decisions and save money on your SR22 insurance policy. Remember to stay current on your SR22 insurance to avoid any penalties or fines, and drive safely to maintain a good driving record.

[ad_2]