With Help From Post Malone, Stanley 1913 Wants to Show It Sells More Than Cups

Posted in: UncategorizedNew chief brand officer Kate Ridley outlines her culture-first strategy to expand Stanley’s brand image.

New chief brand officer Kate Ridley outlines her culture-first strategy to expand Stanley’s brand image.

Car insurance cost is an important factor to consider when purchasing a vehicle, and the 1993 Mitsubishi Mighty Max Macro Cab is no exception. This compact pickup truck, known for its reliability and versatility, has gained popularity among car enthusiasts and individuals looking for a practical and affordable vehicle. To help you make an informed decision, here are the affordable rates offered by the top three insurance companies for the 1993 Mitsubishi Mighty Max Macro Cab, along with some cool facts about the car.

1. Progressive Insurance: Progressive is known for its competitive rates and customizable coverage options. For the 1993 Mitsubishi Mighty Max Macro Cab, Progressive offers an average annual premium of $800. This rate may vary depending on factors such as the driver’s age, location, driving history, and desired coverage limits.

2. GEICO Insurance: GEICO is renowned for its excellent customer service and affordable rates. For the 1993 Mitsubishi Mighty Max Macro Cab, GEICO offers an average annual premium of $750. This rate can be further reduced by taking advantage of various discounts such as safe driver, multi-policy, and anti-theft device discounts.

3. State Farm Insurance: State Farm is one of the largest insurance providers in the United States, offering a wide range of coverage options. For the 1993 Mitsubishi Mighty Max Macro Cab, State Farm offers an average annual premium of $850. This rate may vary depending on the driver’s location, driving record, and coverage requirements.

Now, let’s delve into some cool facts about the 1993 Mitsubishi Mighty Max Macro Cab. This compact pickup truck was manufactured by Mitsubishi Motors from 1978 to 1996. It featured a spacious and practical interior, making it an ideal choice for both personal and commercial use. The Mighty Max Macro Cab was equipped with a 2.4-liter four-cylinder engine, delivering a respectable 116 horsepower.

One interesting feature of the Mighty Max Macro Cab was its removable rear jump seats. This allowed for additional passenger seating or extra storage space, depending on the driver’s needs. The truck also featured rear-wheel drive and a sturdy ladder frame, ensuring durability and stability on various terrains.

Another fascinating fact about this vehicle is its towing capacity. The 1993 Mitsubishi Mighty Max Macro Cab had a towing capacity of up to 3,500 pounds, making it suitable for hauling small trailers or boats. This capability further enhanced its versatility and appeal to outdoor enthusiasts.

In conclusion, the 1993 Mitsubishi Mighty Max Macro Cab offers affordable car insurance rates from top companies such as Progressive, GEICO, and State Farm. With rates ranging from $750 to $850 per year, these insurance providers are known for their competitive pricing and comprehensive coverage options. Additionally, the Mighty Max Macro Cab’s practicality, towing capacity, and removable jump seats add to its appeal as a reliable and versatile compact pickup truck.

A Africa Creative anunciou seu novo time criativo: Rogério Chaves e Fabricio Pretto, a dupla conhecida como Rog & Pretto, chegam como co-CCOs em julho. Por que importa: A agência está criando uma estrutura de liderança criativa inédita no Brasil com 4 co-CCOs. É aposta alta em descentralização do poder criativo – ou muita gente …

Leia Rog & Pretto desembarcam na Africa Creative como co-CCOs em mega estrutura criativa na íntegra no B9.

A matemática da Apple finalmente fez sentido. Depois de anos com iOS 18, watchOS 11 e visionOS 2 rodando ao mesmo tempo (tente explicar isso pro seu tio), a empresa jogou a toalha e agora segue o calendário. Por que importa: É admissão tácita de que o sistema anterior era um caos. Mais importante: sinaliza …

Leia Apple desiste de contar e agora todos os sistemas são “26” (spoiler: é o ano) na íntegra no B9.

The court order is part of The New York Times’ copyright lawsuit against OpenAI.

Academy Sports + Outdoors is planting a flag in the ground with the launch of Fun Can’t Lose, a new brand platform built on a simple truth: the journey matters more than the score. Because whether you win or lose, if you’re having fun, you’re winning. Created in partnership with newly appointed agency of record McGarrah Jessee, the platform marks the company’s largest brand-building investment to date and a pivotal step in its evolution as value-driven retailer.

The Fun Can’t Lose campaign includes a series of TV spots, digital films, and social content that highlight the humor and heart behind everyday outdoor moments.

AGENCY: MCGARRAH JESSEE

Chief Creative Officer: Tim Roan

Managing Director: Heather Miller

Creative Director/Copywriter: Colin Lapin

Creative Director/Art Director: Tim Cole

Executive Producer: Abby Hinojosa

Producer: Sean Phung

Group Brand Director: Lauren Heffern

Brand Supervisor: Jeremy Wood

Sr. Brand Manager: Josh DeFord

Group Strategy Director: AJ Hickcox

Sr. Art Director: Ben Estus

Sr. Copywriter: Bryson Schmidt

Associate Creative Director: Page Kastner

Sr. Copywriter: Skyler Dobin

PRODUCTION COMPANY: MJZ

Directors: Hoffman & Metoyer

Executive Producer: Eriks Krumins

Line Producer: Adriana Cebada Mora

POST PRODUCTION COMPANY: CARTEL

Editor: Chris Catanach

Editor: Nick Deliberto

Editor Assist: Scott Beatty

Executive Producer: Viet-An Nguyen

Producer: Savannah Cannistraro

FINISHING HOUSE: TBD POST

Color: Brandon Thomas

Flame: Kagan Durmer

Audio: Brad Engleking

Animation: Chapman Bullock

Executive Producer: Rachel Kichler

Producer: Brent Holt

MUSIC HOUSE: YESSIAN

Head of Production: Michael Yessian

Chief Creative Officer: Brian Yessian

Global Creative Director: Gerard Smerek

Composer (Mnemonic): Mike Schmidt

Composer (Countdown, Statistically): Mark Chu

Composer (Bounce): Nate Morgan

Executive Producer: Evelyn Brown

Creative Producer: Nick von Zumwalt

Sound Designer (Bounce): Weston Fonger

Mix EP (Bounce): Angelina Powers

Car Insurance Cost for 1993 Mitsubishi Mirage: Affordable Rates From Top 3 Companies

When it comes to insuring a 1993 Mitsubishi Mirage, finding affordable car insurance rates is a top priority for many owners. This compact and reliable vehicle has gained popularity for its fuel efficiency and longevity, making it a popular choice among budget-conscious drivers. To help you find the best car insurance rates for your 1993 Mitsubishi Mirage, we have identified three top companies that offer affordable coverage.

1. Geico: Geico is a well-known insurance provider that offers competitive rates for a wide range of vehicles, including the 1993 Mitsubishi Mirage. Geico provides customizable coverage options that cater to the specific needs of each driver. For a 1993 Mitsubishi Mirage, Geico offers an average annual premium of around $900, making it a cost-effective option for many owners.

2. Progressive: Progressive is another reputable insurance company that offers affordable rates for the 1993 Mitsubishi Mirage. With their focus on innovation and customer satisfaction, Progressive provides flexible coverage options to suit different budgets and preferences. On average, the annual premium for a 1993 Mitsubishi Mirage with Progressive is around $950, making it a competitive choice for cost-conscious drivers.

3. State Farm: State Farm is known for its extensive network of agents and personalized service. This insurance provider offers comprehensive coverage options for the 1993 Mitsubishi Mirage at reasonable rates. The average annual premium for a 1993 Mitsubishi Mirage with State Farm is approximately $1,000, making it an affordable choice for many owners who value reliable customer support.

Apart from these affordable car insurance options, the 1993 Mitsubishi Mirage itself has some interesting facts that make it worth considering. This compact car was introduced in 1989 and quickly gained popularity for its fuel efficiency, affordability, and reliability. The Mirage was praised for its excellent gas mileage, with some models achieving up to 40 miles per gallon on the highway, making it a cost-effective choice for daily commutes and long drives.

Additionally, the 1993 Mitsubishi Mirage featured a sleek and aerodynamic design that combined style with practicality. Its compact size made it maneuverable in tight spaces, making it an ideal choice for urban driving. The Mirage also boasted a surprisingly spacious interior, offering ample legroom and cargo space for its size.

Furthermore, the 1993 Mitsubishi Mirage was equipped with various safety features, including dual front airbags and anti-lock brakes, which were considered advanced for its time. These safety features provide peace of mind for drivers and make the Mirage a reliable choice, even by today’s standards.

In conclusion, finding affordable car insurance rates for your 1993 Mitsubishi Mirage is important, considering its popularity among budget-conscious drivers. Geico, Progressive, and State Farm are three insurance companies that offer competitive rates for this vehicle. Additionally, the Mirage’s fuel efficiency, sleek design, and safety features make it a practical and reliable choice for drivers.

The changes allow controversial content to remain on YouTube as long as it is considered to be in the public’s interest.

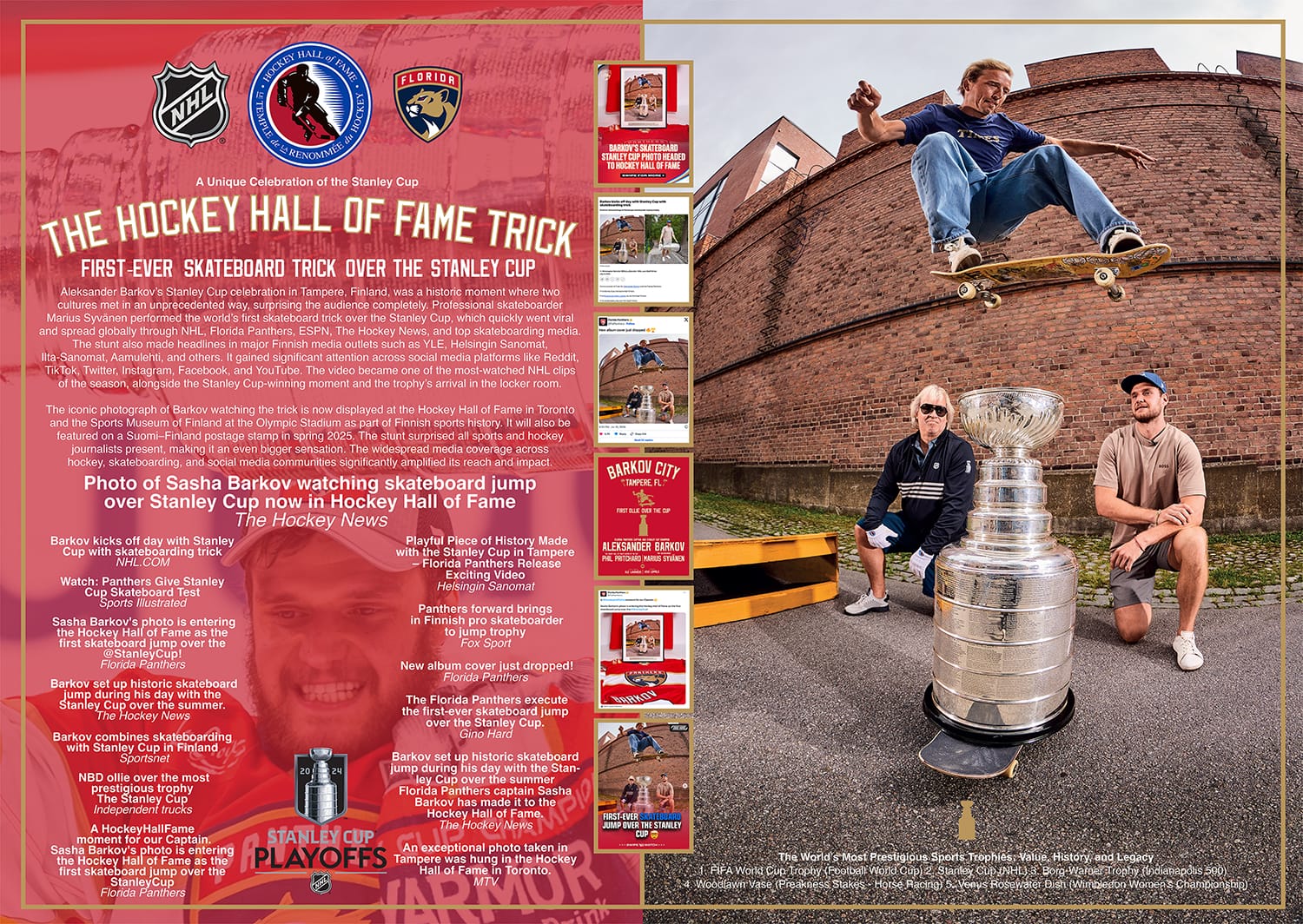

Aleksander Barkov’s Stanley Cup celebration in Tampere, Finland, was a historic moment where two cultures met in an unprecedented way. Professional skateboarder Marius Syvänen performed the world’s first skateboard trick over the Stanley Cup, which quickly went viral and spread globally through NHL, Florida Panthers, ESPN, The Hockey News, and top skateboarding media.

The video became one of the most-watched NHL clips of the season, alongside the Stanley Cup-winning moment and the trophy’s arrival in the locker room.

The iconic photograph of Barkov watching the trick is now displayed at the Hockey Hall of Fame in Toronto and the Sports Museum of Finland at the Olympic Stadium as part of Finnish sports history. It will also be featured on a Suomi–Finland postage stamp in spring 2025.

Credits:

Agency: Studio Lauraéus, Helsinki, Finland

Art Director, Photographer, Creative Director, Graphic Designer, Producer, Videographer: Ale Lauraéus

Professional Skateboarder: Marius Syvänen

Photographer: Keke Leppälä

Hockey Hall of Fame Vice President, Curator/Keeper of the Cup: Phil Pritchard

Florida Panthers Captain, Stanley Cup Champion: Aleksander Barkov

International Sports Advisors Co., Inc.: Ilkka Larva, Director, Europe

Car insurance is an essential aspect of owning a vehicle, and it’s important to find affordable rates that provide adequate coverage. If you own a 1993 Mitsubishi Mighty Max Regular Cab, you’ll be pleased to know that there are several top insurance companies offering competitive rates for this particular model.

One of the most reputable insurance providers for the 1993 Mitsubishi Mighty Max Regular Cab is Geico. Known for their competitive pricing and excellent customer service, Geico offers affordable rates for this vehicle. On average, the annual premium for car insurance with Geico for a 1993 Mitsubishi Mighty Max Regular Cab is around $800. This rate may vary depending on factors such as your location, driving history, and selected coverage options.

Another popular insurance company to consider is Progressive. With their extensive network of agents and user-friendly online platform, Progressive offers competitive rates for the 1993 Mitsubishi Mighty Max Regular Cab. On average, the annual premium for car insurance with Progressive for this vehicle is approximately $900. Keep in mind that this rate can vary based on individual circumstances and coverage preferences.

State Farm is also a reputable insurance company that provides competitive rates for the 1993 Mitsubishi Mighty Max Regular Cab. With a strong presence in the insurance market, State Farm offers reliable coverage options at affordable prices. On average, the annual premium for car insurance with State Farm for this particular model is around $950. However, it’s important to note that this rate can fluctuate based on various factors, including your location and driving record.

Now, let’s move on to some cool facts about the 1993 Mitsubishi Mighty Max Regular Cab. This compact pickup truck was produced by Mitsubishi Motors from 1982 to 1996. It boasted a 2.4-liter inline-four engine, capable of producing 116 horsepower and 149 lb-ft of torque. The Mighty Max Regular Cab offered a spacious interior and a generous cargo bed, making it a versatile vehicle for both work and leisure activities.

In terms of safety, the 1993 Mitsubishi Mighty Max Regular Cab featured standard driver-side airbags, reinforcing its commitment to occupant protection. Additionally, this model was known for its reliability and durability, making it a popular choice among truck enthusiasts.

In conclusion, if you own a 1993 Mitsubishi Mighty Max Regular Cab, you have several options to find affordable car insurance rates. Geico, Progressive, and State Farm are top insurance companies offering competitive premiums for this vehicle. With rates averaging around $800 to $950 per year, you can ensure both your vehicle and your wallet are well-protected.

“You just (expletive) shot the reporter,” a voice off-camera can be heard shouting.

Mr. Baldoni had accused Ms. Lively and her husband, Ryan Reynolds, of trying to destroy his reputation. The Times had brought the feud into the public eye.

Entropico comedy directors Paxi & Cem reunited with VaynerMedia and Mountain Dew to invite tired parents everywhere to feel the magic of turbo parenting TODAY!

The new ‘Do the Dew’ spot stars actor Danny Kim as a frazzled parent seeking energy to escape his endless cycle of wiping things and questioning his life choices.

VaynerMedia and Entropico

Shchi Production shows us what the latest AI creative tools (production stack: Runway, Sora, Flow, Kling, Krea, Midjourney, Higgsfield, Luma, DaVinci Resolve, Adobe After Effects) can bring to the world of advertising with this ad spec for adidas.

Shchi Studio Director, AI Producer — Evgeny Pyriev

AI Producer, Motion Designer — Alexander Martynov

Car Insurance Cost for 1993 Pontiac Firebird: Affordable Rates From Top 3 Companies

Owning a classic car like the 1993 Pontiac Firebird can be a dream come true for many car enthusiasts. However, it’s important to consider the cost of car insurance to protect your investment and ensure peace of mind on the road. In this article, we will explore the affordable rates offered by the top three insurance companies for the 1993 Pontiac Firebird, along with some cool facts about the car.

1. Geico Insurance:

Geico is known for offering competitive rates and excellent customer service. For a 1993 Pontiac Firebird, Geico provides comprehensive coverage at an affordable rate of $800 per year. This rate takes into account factors such as the car’s age, condition, and value, as well as the driver’s age, driving history, and location.

2. Progressive Insurance:

Progressive is another leading insurance company that offers attractive rates for classic cars. For a 1993 Pontiac Firebird, Progressive provides comprehensive coverage at a rate of $900 per year. Progressive takes into consideration the car’s age, condition, and value, as well as the driver’s age, driving history, and location to determine the premium.

3. State Farm Insurance:

State Farm is a trusted insurance provider that offers competitive rates for classic cars. For a 1993 Pontiac Firebird, State Farm provides comprehensive coverage at a rate of $1,000 per year. State Farm considers several factors including the car’s age, condition, value, the driver’s age, driving history, and location to calculate the premium.

Now, let’s dive into some cool facts about the 1993 Pontiac Firebird:

1. Performance: The 1993 Pontiac Firebird was equipped with a powerful V6 or V8 engine, depending on the trim level. This muscle car could deliver impressive acceleration and top speeds, making it a favorite among speed enthusiasts.

2. Iconic Design: The Firebird’s sleek and aerodynamic design was an instant hit, featuring a distinctive front grille, pop-up headlights, and a rear spoiler. Its bold and aggressive appearance turned heads wherever it went.

3. Trans Am Special Edition: The 1993 Pontiac Firebird Trans Am came in a special edition called the “10th Anniversary Edition.” This limited edition model featured unique silver paint, a commemorative badge, and a luxurious interior with leather seats.

4. Pop Culture Status: The Pontiac Firebird gained significant popularity through its appearances in movies and TV shows. Most notably, it starred alongside David Hasselhoff in the hit TV series “Knight Rider” as the iconic talking car, KITT.

5. Collectible Value: As a classic car, the 1993 Pontiac Firebird has gained collectible status over the years. Its unique design and performance capabilities have made it highly sought after by car collectors and enthusiasts alike.

In conclusion, while the cost of car insurance for a 1993 Pontiac Firebird may vary depending on several factors, Geico, Progressive, and State Farm are reputable insurance companies offering affordable rates for this classic car. Owning a 1993 Pontiac Firebird not only provides a thrilling driving experience but also gives you the opportunity to own a piece of automotive history.

A VML Brasil decidiu atacar o problema da falta de mulheres na publicidade com uma solução nada óbvia: speed dating profissional. Não é Tinder, é formação de dupla criativa. Por que importa: Enquanto o mercado fala sobre diversidade há anos, a VML propõe um pipeline concreto. O formato speed dating pode parecer artifício, mas resolve …

Leia VML cria speed dating criativo para formar duplas femininas na íntegra no B9.

Five former Madwell employees have been tapped to form a millennial and Gen Z-focused division within the full-service agency Gravity Global.

Car insurance is an essential aspect of owning a vehicle, ensuring financial protection in case of accidents, theft, or any other unforeseen circumstances. If you are a proud owner of a 1993 Mitsubishi Montero, you might be wondering about the car insurance cost for this particular model. To assist you in making an informed decision, we have researched and compiled the affordable rates offered by the top three car insurance companies for this vehicle.

The Mitsubishi Montero, a rugged and reliable SUV, has been a popular choice among adventure enthusiasts since its introduction in 1982. Known for its off-road capabilities, the Montero has garnered a strong following over the years. However, it’s important to consider the cost of insuring this vehicle, as it can vary depending on several factors such as your location, driving history, and the coverage options you choose.

Among the top car insurance providers, Geico is renowned for its competitive rates and excellent customer service. For a 1993 Mitsubishi Montero, Geico offers an average annual premium of $600. This rate is based on a standard coverage plan, including liability, collision, and comprehensive coverage.

Progressive is another reputed insurance company that offers affordable rates for the Mitsubishi Montero. With an average annual premium of $650, Progressive provides comprehensive coverage options for your vehicle, ensuring peace of mind on and off the road.

State Farm, known for its extensive network of local agents, also offers competitive rates for the 1993 Mitsubishi Montero. Their average annual premium for this vehicle is around $700, providing policyholders with a range of coverage options to suit their needs.

Now, let’s delve into some cool facts about the 1993 Mitsubishi Montero. This model marked the fourth generation of the Montero line, featuring a more streamlined and aerodynamic design compared to its predecessors. It came equipped with a 3.0-liter V6 engine, delivering a respectable 151 horsepower.

The 1993 Montero boasted impressive off-road capabilities, thanks to its Super Select 4WD system, which allowed drivers to switch between two-wheel drive and four-wheel drive modes on the fly. This feature made it an ideal choice for both on-road and off-road adventures.

In terms of safety, the 1993 Montero was equipped with driver and passenger airbags, anti-lock brakes, and a reinforced body structure. These safety features, combined with its rugged build, made it a reliable choice for families and outdoor enthusiasts alike.

In conclusion, while owning a 1993 Mitsubishi Montero can be an exciting prospect, it is crucial to consider the cost of insuring this vehicle. Based on our research, Geico, Progressive, and State Farm offer affordable rates for the 1993 Mitsubishi Montero, allowing you to enjoy your adventures without breaking the bank. Remember to compare quotes, consider your specific requirements, and consult with insurance agents to find the best coverage options for your needs.

Car Insurance Cost for 1993 Oldsmobile Achieva: Affordable Rates From Top 3 Companies

When it comes to insuring a 1993 Oldsmobile Achieva, it is important to find the best insurance rates from reliable companies. The cost of car insurance can vary depending on factors such as the driver’s age, location, driving history, and the car’s make and model. However, we have researched and found three top insurance companies that offer affordable rates for the 1993 Oldsmobile Achieva.

1. GEICO: GEICO is a well-known insurance company that offers competitive rates for a wide range of vehicles. For a 1993 Oldsmobile Achieva, GEICO offers an average annual premium of around $700. This rate is based on a hypothetical driver with a clean driving record, aged between 30-40 years, and living in a suburban area.

2. State Farm: State Farm is another reputable insurance provider that offers affordable rates for the 1993 Oldsmobile Achieva. On average, State Farm offers an annual premium of approximately $800 for this vehicle. Similar to the GEICO rate, this estimate is based on a driver with a good driving history and other relevant factors.

3. Progressive: Progressive is known for its competitive rates and extensive coverage options. For a 1993 Oldsmobile Achieva, Progressive offers an average annual premium of around $900. While slightly higher than GEICO and State Farm, Progressive still provides an affordable option for insuring this vehicle.

Now, let’s delve into some cool facts about the 1993 Oldsmobile Achieva. The Achieva was a compact car produced by the American automaker Oldsmobile from 1992 to 1998. It was introduced as a replacement for the Oldsmobile Cutlass Calais and was available in sedan and coupe body styles.

The 1993 Oldsmobile Achieva came with a variety of engine options, including a 2.3L inline-four, a 2.4L inline-four, and a 3.3L V6 engine. The car offered decent performance and fuel efficiency for its time.

One interesting feature of the Achieva was the availability of a Quad 4 engine, which was a high-performance variant of the 2.3L inline-four. The Quad 4 engine produced around 180 horsepower, making the Achieva a fun and sporty option in its segment.

The Achieva also boasted some advanced safety features for its time, including anti-lock brakes and optional driver’s side airbags. These features enhanced the overall safety of the vehicle and helped protect the driver and passengers in case of a collision.

In conclusion, insuring a 1993 Oldsmobile Achieva can be affordable if you choose the right insurance company. GEICO, State Farm, and Progressive offer competitive rates for this vehicle. Additionally, the 1993 Oldsmobile Achieva was a reliable and sporty car that offered decent performance and safety features.

WBD president and CEO David Zaslav announced the plan on Monday.