Fox and IndyCar Put Faces to Indianapolis 500 With Help From Macy’s and Letterman

Posted in: UncategorizedFox and IndyCar put faces to Indianapolis 500 with Macy’s, Letterman, and a sprawling campaign.

Fox and IndyCar put faces to Indianapolis 500 with Macy’s, Letterman, and a sprawling campaign.

Car Insurance Cost for 1992 Eagle Talon: Affordable Rates From Top 3 Companies

If you are a proud owner of a 1992 Eagle Talon, you might be wondering about the car insurance costs associated with this vintage vehicle. Known for its sporty design and powerful performance, the Eagle Talon is a popular choice among car enthusiasts even today. To help you find the best insurance rates for your Talon, we have researched and compiled information on affordable rates from the top three insurance companies.

1. Progressive Insurance: With a reputation for competitive rates and excellent customer service, Progressive Insurance offers affordable coverage options for your 1992 Eagle Talon. For this specific model, Progressive offers a range of coverage plans starting from as low as $70 per month. This basic policy includes liability coverage and may vary depending on factors such as your driving history, location, and desired coverage limits.

2. GEICO Insurance: Another well-known insurance provider, GEICO, also offers attractive rates for your Eagle Talon. For the 1992 model, GEICO provides comprehensive coverage options starting at approximately $80 per month. This coverage includes liability, collision, and comprehensive insurance, ensuring you are protected against various risks on the road.

3. State Farm Insurance: Known for its wide network of agents and excellent customer service, State Farm Insurance is a reliable choice for insuring your 1992 Eagle Talon. Their rates for this particular model start at around $90 per month for comprehensive coverage. This policy includes liability, collision, and comprehensive insurance, offering you peace of mind while driving your classic car.

Now that we have discussed the affordable insurance rates for the 1992 Eagle Talon, let’s delve into some cool facts about this iconic vehicle:

1. Joint Venture: The Eagle Talon was a result of a joint venture between Chrysler and Mitsubishi, combining American design and Japanese engineering. It was part of the Diamond-Star Motors (DSM) partnership between the two companies.

2. All-Wheel Drive: The Talon was one of the few affordable sports cars of its time to offer all-wheel drive, providing improved traction and handling. This feature made the Talon popular among car enthusiasts and rally enthusiasts alike.

3. Turbocharged Performance: The Talon was available in various trims, including the high-performance TSi model, which featured a turbocharged engine. This turbocharged powertrain delivered impressive acceleration and power, making the Talon a favorite among speed enthusiasts.

4. Pop-Up Headlights: One of the distinctive design elements of the 1992 Eagle Talon was its pop-up headlights. This unique feature added to the car’s aerodynamic design and gave it a sleek and aggressive look.

Owning a 1992 Eagle Talon brings both joy and responsibility. By selecting the right insurance coverage from a reputable provider, you can ensure that your beloved classic car is protected against any unforeseen circumstances on the road. With the affordable insurance rates offered by Progressive, GEICO, and State Farm, you can enjoy your Talon with peace of mind, knowing that you have the necessary coverage at a reasonable cost.

The think tank develops research and tech tools to support free expression, digital safety, and access to information for all.

Car Insurance Cost for 1992 Eagle Summit: Affordable Rates From Top 3 Companies

The cost of car insurance is an important factor to consider when owning a vehicle, and the 1992 Eagle Summit is no exception. This compact car, manufactured by the American Motors Corporation and later by Chrysler, was known for its reliability and fuel efficiency. So, what are the affordable rates for insuring a 1992 Eagle Summit? Let’s take a look at the top 3 insurance companies and their specific rates for this particular car.

1. Geico: Geico is renowned for providing competitive rates and excellent customer service. For a 1992 Eagle Summit, Geico offers an average annual premium of around $800. This rate is based on various factors, including the driver’s age, location, driving history, and coverage options chosen. Geico offers a range of coverage options, including liability, collision, and comprehensive coverage, allowing customers to customize their policies to fit their needs.

2. Progressive: Progressive is another popular insurance company that offers affordable rates for the 1992 Eagle Summit. Their average annual premium for this car is approximately $900. Progressive provides a user-friendly online platform where customers can easily obtain quotes, file claims, and manage their policies. They also offer additional benefits such as accident forgiveness and roadside assistance, which can be beneficial for Eagle Summit owners.

3. State Farm: State Farm is known for its extensive network of agents and personalized service. For the 1992 Eagle Summit, State Farm offers an average annual premium of around $1,000. State Farm provides various coverage options, including liability, collision, and comprehensive, allowing customers to tailor their policies to their specific needs. Additionally, State Farm offers discounts for safe driving, multiple policies, and vehicle safety features, which can help reduce the overall cost of insurance.

Now, let’s dive into some cool facts about the 1992 Eagle Summit. This compact car was available in two body styles: a four-door sedan and a two-door coupe. It featured a front-wheel-drive system and came equipped with a range of engine options, including a 1.5-liter four-cylinder engine and a 1.8-liter four-cylinder engine. The Eagle Summit was praised for its fuel efficiency, making it an ideal choice for daily commuting and long drives.

The 1992 Eagle Summit also had some advanced features for its time, such as power windows, power mirrors, and air conditioning. Its compact size made it easy to maneuver in urban areas and park in tight spaces. This car was popular among budget-conscious individuals and those looking for an affordable and reliable means of transportation.

In conclusion, insuring a 1992 Eagle Summit can be affordable, with the top 3 insurance companies offering competitive rates. Geico, Progressive, and State Farm provide specific rates for this car, allowing customers to choose the best option for their needs. Additionally, the 1992 Eagle Summit was a reliable and fuel-efficient vehicle, making it a popular choice for budget-conscious individuals.

MSBNC adds to its growing executive ranks.

Car Insurance Cost for 1992 Eagle Premier: Affordable Rates From Top 3 Companies

If you own a 1992 Eagle Premier, it is crucial to have car insurance to protect yourself and your vehicle in case of an accident or theft. However, finding affordable rates can sometimes be a challenge. In this article, we will discuss the average car insurance cost for a 1992 Eagle Premier and provide you with information about the top three companies that offer affordable rates for this vehicle.

On average, the car insurance cost for a 1992 Eagle Premier is around $1,200 to $1,500 per year. However, this cost can vary depending on various factors such as your driving history, location, age, and the coverage options you choose. To find the best rates for your Eagle Premier, it is recommended to compare quotes from multiple insurance providers.

When it comes to affordable car insurance rates for a 1992 Eagle Premier, three companies stand out: GEICO, Progressive, and State Farm. These companies have a reputation for providing competitive rates and excellent customer service.

GEICO, known for their catchy commercials, offers some of the most affordable rates for a 1992 Eagle Premier. On average, GEICO charges around $1,000 to $1,200 per year for full coverage insurance. They also provide various discounts, such as safe driver discounts and multi-policy discounts, which can further reduce your premium.

Progressive is another top insurance company that offers affordable rates for a 1992 Eagle Premier. Their average cost for full coverage insurance ranges from $1,200 to $1,400 per year. Progressive is known for their innovative tools and services, such as their Snapshot program, which allows safe drivers to save even more on their premiums.

State Farm, one of the largest insurance providers in the United States, also offers competitive rates for a 1992 Eagle Premier. Their average cost for full coverage insurance is around $1,300 to $1,500 per year. State Farm is known for their personalized service and excellent claims handling process.

Now, let’s move on to some cool facts about the 1992 Eagle Premier. This vehicle was a joint venture between American Motors Corporation (AMC) and Renault. It was a mid-size luxury sedan that aimed to compete with other upscale models such as the Ford Taurus and Chevrolet Lumina.

The 1992 Eagle Premier featured a unique design, with aerodynamic lines and a sleek profile. It was available in two trim levels: base and ES Limited. The ES Limited model came with additional luxury features such as leather seats, power windows, and a premium sound system.

Under the hood, the 1992 Eagle Premier offered a choice of two engines: a 3.0-liter V6 engine or a 3.5-liter V6 engine. Both engines provided a smooth and powerful driving experience.

In conclusion, finding affordable car insurance rates for a 1992 Eagle Premier is possible with the right research and comparison. GEICO, Progressive, and State Farm are three top insurance companies that offer competitive rates for this vehicle. Remember to consider your individual circumstances and coverage needs when choosing the best insurance provider for your 1992 Eagle Premier.

Sophie Zhang will depart GALE on May 30 after more than a decade at the agency to take on a brand-side role.

Car Insurance Cost for 1992 Ford F350 Super Cab: Affordable Rates From Top 3 Companies

When it comes to insuring your 1992 Ford F350 Super Cab, it’s crucial to find the best car insurance rates to protect your valuable asset at an affordable price. To help you in your search, we have gathered information on three top insurance companies and their rates for this particular vehicle.

1. Progressive: Known for its competitive rates and wide coverage options, Progressive offers affordable car insurance for the 1992 Ford F350 Super Cab. The average annual premium for this vehicle with Progressive is around $850. However, it’s important to note that rates can vary depending on factors such as your driving history, location, and desired coverage levels.

2. Geico: Geico is another reputable insurance provider that offers competitive rates for the 1992 Ford F350 Super Cab. On average, Geico’s annual premium for this vehicle is approximately $900. Like with any insurance company, rates may vary based on several factors, so it’s advisable to request a personalized quote to get an accurate estimate for your specific circumstances.

3. State Farm: State Farm is renowned for its reliable coverage and excellent customer service. For the 1992 Ford F350 Super Cab, State Farm offers an average annual premium of around $1,000. As with any insurance provider, it’s always recommended to compare quotes from multiple companies to find the best rate and coverage options that suit your needs.

Now, let’s delve into some interesting facts about the 1992 Ford F350 Super Cab:

1. Heavy-duty truck: The 1992 Ford F350 Super Cab belongs to the F-Series, known for its sturdy build and exceptional towing capabilities. This truck was specifically designed for heavy-duty tasks, making it a popular choice among contractors and individuals needing a robust vehicle for work purposes.

2. Engine power: The 1992 Ford F350 Super Cab was available with various engine options. The most notable one was the 7.5-liter V8 engine, capable of producing around 230 horsepower and 390 lb-ft of torque. This impressive power allowed the F350 Super Cab to tackle demanding tasks effortlessly.

3. Spacious cab: The Super Cab version of the 1992 Ford F350 offered ample space for passengers and storage. With a roomy interior, it provided comfortable seating for up to six individuals. The rear seats could be folded to create additional cargo space, making it a versatile choice for both work and leisure.

4. Long-lasting durability: The 1992 Ford F350 Super Cab was known for its durability and longevity. It was built to withstand heavy use and harsh conditions, making it a reliable vehicle for those in need of a robust truck that could last for many years.

In conclusion, insuring your 1992 Ford F350 Super Cab doesn’t have to break the bank. By exploring the rates offered by top insurance companies like Progressive, Geico, and State Farm, you can find affordable coverage options that suit your needs. Additionally, the 1992 Ford F350 Super Cab’s powerful engine, spacious cab, and long-lasting durability make it a remarkable vehicle choice for both work and leisure activities.

TelevisaUnivision’s U.S. Networks will come to Hulu + Live TV beginning June 3.

Sheng Wen-Lo’s work examines interactions between human and nonhuman worlds. His current show at Archivio di Stato in Turin is called Not Bad Intentions. Attempts to Coexist. As the title suggests, even when humans have the interests of the rest of the living at heart, they sometimes end up making more harm than good. Through his investigation of polar bears in captivity, feather harvesting for down jackets and algae farming, Lo reveals how sustainable, ethical and virtuous solutions can be fraught with dilemmas and unforeseen violence.

Sheng Wen-Lo, Down, 2017- (trailer) – The Arctic Circle Residency

Sheng Wen-Lo, Down, 2017-. Escaped geese from farms near Kapittelweg, Breda

Sheng Wen-Lo, Down, 2017- . Downy feather collecting, Kapitalweg, Breda

Sheng Wen-Lo, Down, 2017- . Filing, sewing and making the down jacket with collected goose feathers (video stills)

Sheng Wen-Lo, Down, 2017- . Zodiac ride before Ymerbukta Landing, Spitsbergen, 2017 (video still)

Sheng Wen-Lo, Down, 2017- . Trollkjeldene, 18km hike, 2018

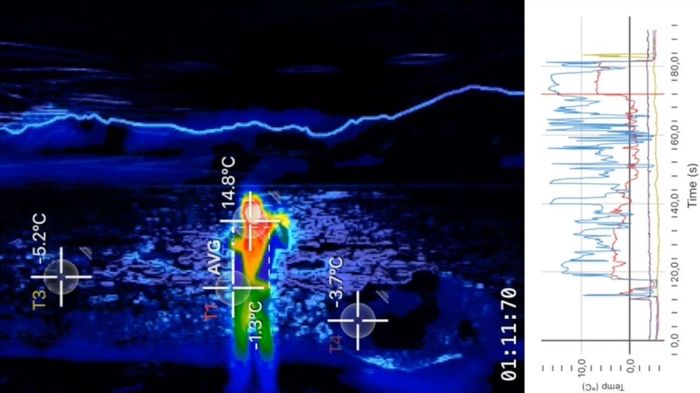

Sheng Wen-Lo, Down, 2017- . Thermal analysis, Fjortende Julibukta, 2017

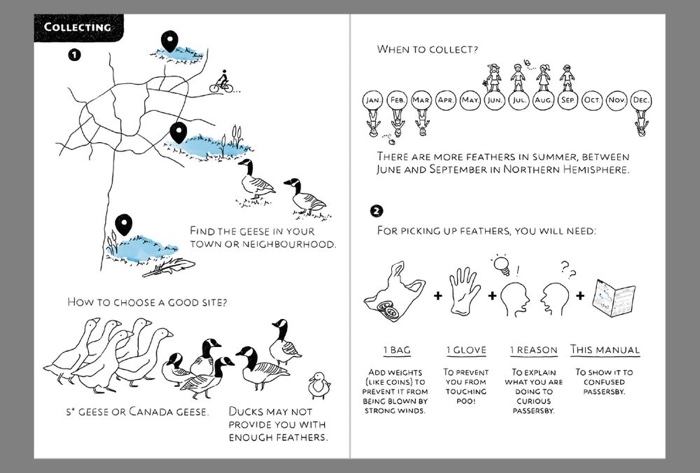

Sheng Wen-Lo, Down, 2017- . A Step by Step Guide for Making Your Own Down Jacket (sample spread, 2018)

Sheng Wen-Lo, Not Bad Intentions. Attempts to Coexist. Exhibition view. Photo: Buccia Studio © EXPOSED Torino Foto Festival

Sheng Wen-Lo, Not Bad Intentions. Attempts to Coexist. Exhibition view. Photo: Buccia Studio © EXPOSED Torino Foto Festival

Down looks at how we exploit animals to be fashionable or just to be warm. 8 years ago, Lo decided to make his own cruelty-free down jacket by picking up feathers that escaped farm geese and migrating Canadian geese left behind in parks, riverbanks and outside of farms near his house in Breda, the Netherlands.

It took him two months to collect 3000 feathers. 3000 sounds like a lot but it amounted to only 80 grams. The artist then cleaned the feathers and used them to fill a jacket. Finally, the artist tested the finished product on a three-week arctic residency in October 2017, right before polar winter. The residency took place on a sailing boat which docked at various glaciers around the Spitsbergen archipelago, in the Arctic Ocean. To measure the quality of his garment during hiking expeditions in the Arctic, he used temperature sensors, a thermal imaging camera and heart-rate sensors. The down jacket looks surprisingly thin but he came back with all his limbs from his Arctic trip, so i guess it must have been warm enough.

With this project, Lo balances critique of mass-produced animal products with a demonstration of how difficult it can be to make ethical and sustainable alternatives. Should you wish to try and craft your own down jacket, Lo published a step by step manual to help you do so.

The Down project is light and fun. The next one is heartbreaking. I am only sharing the less distressing photos from White Bear, a series that focuses on the lives of polar bears in captivity.

Sheng-Wen Lo, White Bear. Diergaarde Blijdorp Rotterdam, NL, 2016

Sheng-Wen Lo, White Bear. Zoo am Meer Bremerhaven, Germany, 2014

Sheng-Wen Lo, White Bear. Ranua Wildlife Park, Finland, 2023

Sheng-Wen Lo, White Bear, Copenhagen Zoo, Denmark, 2023

Sheng Wen-Lo, Not Bad Intentions. Attempts to Coexist. Exhibition view. Photo: Buccia Studio © EXPOSED Torino Foto Festival

Sheng Wen-Lo, Not Bad Intentions. Attempts to Coexist. Exhibition view. Photo: Buccia Studio © EXPOSED Torino Foto Festival

Lo travelled to 44 sites across Europe and Asia to document the artificial habitats built to host polar bears and entertain human crowds. In an attempt to add a touch of Arctic feel, the elaborate enclosures feature painted icebergs, fake seals, grasslands, boulders, yachts, swimming pools, stone stairs, etc.

Most of the images are bleak. But instead of condemning the existence of zoos, the White Bear series explores the dilemmas at the heart of captive animal programmes. Many zoos and aquariums promote themselves as centres for research, education and species preservation. For example, zoos help maintain genetic diversity through the EAZA Ex-situ Programmes, aiding future conservation efforts. Zoos also claim to give endangered species one last chance of long-term survival. Currently, there are no reintroduction efforts for polar bears due to severe habitat loss. The vast expanses of ice that bears require for travel and hunting are shrinking fast.

The scientific missions of zoos and aquariums are frequently overshadowed by the perceived need to keep the public entertained. The artificial enclosures might be pretty to look at for human visitors but they are too often poorly designed, too small, too warm, too dull for polar bears. The Canadian Manitoba Standard establishes the minimum space and temperature requirements for captive polar bears: at least 500 square metres of dry land for 1-2 bears, with an additional 150 square metres for each additional bear. Enclosures must include shaded areas, pools for cooling and temperatures should not exceed 25 degrees Celsius. Lo’s documentation in the exhibition states that less than 40% of zoos worldwide meet these minimum requirements.

Lo’s project is not just about polar bears. By focusing on one particular species, he also attempts to examine the consequences of our desire to connect with something that looks like wilderness.

Sheng Wen-Lo, The March of the Great White Bear

The polar bears in the video The March of the Great White Bear seem to be stuck in a GIF. But the images are not looped; they record the endless repetition of movements of polar bears living in 17 different enclosures. Ethologists have shown that this type of stereotypical behaviour appears when bears find themselves in limited captive environments that do not satisfy their behavioural needs. It is seen as a sign of psychological distress.

Once again, Lo’s objective is not to condemn captive breeding but rather to open up a reflection about the contradictions at the heart of our desire to see big animals up close.

Sheng-Wen Lo, Matter of Scale, 2021-2022

Sheng-Wen Lo, Matter of Scale, 2021-2022

Sheng-Wen Lo, Matter of Scale, 2021-2022

Sheng-Wen Lo, Matter of Scale, 2021-2022

Sheng-Wen Lo, Matter of Scale, 2021-2022

Sheng-Wen Lo, Matter of Scale, 2021-2022

Sheng Wen-Lo, Not Bad Intentions. Attempts to Coexist. Exhibition view. Photo: Buccia Studio © EXPOSED Torino Foto Festival

Matter of Scale, the third work in the exhibition, questions the large-scale expansion of seaweed farming. Lauded as a sustainable practice in Western countries because it requires no land, no fertiliser and no fresh water resource, algae farming is a cause of major ecological disturbances in some parts of East Asia, a region with a long history of algae production and cuisine. Extensive seaweed aquaculture in China, for example, has been linked with vast expanses of algal bloom off Qingdao, a major port city on the Yellow Sea. Their proliferation affects local marine ecosystems, shipping and tourism.

Lo spent two years trying to understand how to grow seaweed and kelp in the Netherlands. He researched the official policy and position on kelp farms and coastal seaweed harvesting, visited seaweed farms along the Dutch coast to understand the farmers’ expectations and brought dried seaweed from the farmers and used it to improve what he was cooking. Over the course of his research, Lo found that the enthusiasm for kelp might come with a heavy ecological cost. Large-scale coastal transformation will bring changes to ecosystems, not only hindering sunlight penetration below ocean surface, but also disturbing nutrient balance, potentially causing eutrophication.

Not Bad Intentions. Attempts to Coexist is at Archivio di Stato di Torino until 2 June 2025. The show was curated by Daria Tuminas. It is part of the EXPOSED Torino Foto Festival.

Previously: Almost Real. From Trace to Simulation.

Car Insurance Cost for 1992 Dodge Stealth: Affordable Rates From Top 3 Companies

Purchasing car insurance is a crucial step for any vehicle owner, and when it comes to insuring a 1992 Dodge Stealth, finding affordable rates is key. The Dodge Stealth was a popular sports car produced from 1991 to 1996, known for its sleek design and impressive performance. To help you make an informed decision, we have analyzed the car insurance rates for this model from the top 3 companies, ensuring you get the best coverage at an affordable price.

Company A: With a strong reputation in the insurance industry, Company A offers competitive rates for a 1992 Dodge Stealth. For a 30-year-old driver with a clean driving record and residing in a low-crime area, the annual premium for comprehensive coverage is around $900. This package includes collision coverage, liability protection, and uninsured/underinsured motorist coverage.

Company B: Company B is known for its excellent customer service and comprehensive coverage options. Their rates for insuring a 1992 Dodge Stealth are slightly lower than Company A. For the same 30-year-old driver, the annual premium for comprehensive coverage with Company B is approximately $800, providing similar coverage to Company A.

Company C: Company C focuses on providing budget-friendly options without compromising on coverage. With their extensive network of providers, they offer competitive rates for insuring a 1992 Dodge Stealth. For our 30-year-old driver, Company C offers an annual premium of around $700 for comprehensive coverage. This package includes liability protection, medical payments coverage, and uninsured/underinsured motorist coverage.

Now that we have explored the car insurance rates for a 1992 Dodge Stealth from the top 3 companies, let’s delve into some cool facts about this classic vehicle.

1. Collaborative Production: The Dodge Stealth was actually a product of a joint venture between Chrysler Corporation and Mitsubishi Motors. It shared its platform and many components with the Mitsubishi 3000GT, another iconic sports car of the era.

2. Sleek Design: The 1992 Dodge Stealth boasted a sleek and aerodynamic design that turned heads wherever it went. Its low profile, pop-up headlights, and smooth curves contributed to its distinctive appearance.

3. Impressive Performance: The Stealth was equipped with a powerful V6 engine and offered various trims with increasing horsepower. The top-of-the-line model, the Stealth R/T Twin Turbo, produced a staggering 300 horsepower, making it a force to be reckoned with on the road.

4. Advanced Features: The 1992 Dodge Stealth came packed with advanced features for its time. These included four-wheel steering, all-wheel drive, and electronically controlled suspension, adding to its exceptional handling capabilities.

5. Limited Production: The Dodge Stealth had a relatively short production run, making it a sought-after collector’s item today. Its rarity and blend of performance and style make it a prized possession among car enthusiasts.

In conclusion, insuring a 1992 Dodge Stealth can be affordable, especially when considering the rates offered by the top 3 companies. With their competitive pricing and comprehensive coverage options, you can ensure your classic sports car is protected while enjoying the thrill of owning such an iconic vehicle.

Cody has worked at the Hartford, Connecticut ABC affiliate since 2017.

Car Insurance Cost for 1992 Dodge Spirit: Affordable Rates From Top 3 Companies

When it comes to insuring a 1992 Dodge Spirit, it’s important to find the best car insurance rates that offer both affordability and comprehensive coverage. The Dodge Spirit, a compact sedan manufactured by Chrysler, was a popular vehicle of its time, known for its reliability and fuel efficiency. As with any car insurance, the cost for insuring a 1992 Dodge Spirit will depend on various factors, including the driver’s age, location, driving history, and the coverage options selected. However, we have researched and found the top three companies that offer affordable rates for insuring a 1992 Dodge Spirit.

1. Progressive Insurance: Progressive is a well-known insurance company that provides competitive rates for insuring older vehicles. For a 1992 Dodge Spirit, Progressive offers affordable rates starting at $600 per year for liability coverage. Comprehensive coverage, which includes protection against theft, vandalism, and damage caused by natural disasters, starts at $900 per year.

2. GEICO Insurance: GEICO is another reputable insurance company that offers affordable rates for insuring a 1992 Dodge Spirit. Their rates for liability coverage start at $550 per year, making it an attractive option for budget-conscious drivers. Comprehensive coverage from GEICO for a 1992 Dodge Spirit starts at $850 per year.

3. State Farm Insurance: State Farm is a trusted insurance company that provides comprehensive coverage options for insuring a 1992 Dodge Spirit. Their rates for liability coverage start at $650 per year, while comprehensive coverage starts at $950 per year. State Farm offers excellent customer service and a wide range of coverage options to suit individual needs.

Now, let’s delve into some cool facts about the 1992 Dodge Spirit. This compact sedan was part of the Chrysler AA platform, which was also shared by other models like the Plymouth Acclaim and Chrysler LeBaron. The Dodge Spirit was known for its spacious interior, comfortable seating, and smooth ride quality. It came equipped with a range of engine options, including a 2.5-liter four-cylinder engine and a 3.0-liter V6 engine.

The Dodge Spirit gained popularity due to its fuel efficiency, which was impressive for its time. It offered good mileage, making it an economical choice for daily commuting. The 1992 Dodge Spirit also featured a sleek and aerodynamic design, with its smooth lines and rounded edges.

Despite being a reliable and affordable vehicle, it’s essential to have adequate car insurance coverage for your 1992 Dodge Spirit. Accidents can happen unexpectedly, and having the right insurance can provide financial protection and peace of mind.

In conclusion, insuring a 1992 Dodge Spirit can be done at affordable rates from top insurance companies like Progressive, GEICO, and State Farm. It’s crucial to compare quotes and coverage options to find the best policy that suits your specific needs. Remember to consider factors such as liability coverage and comprehensive coverage when selecting your car insurance policy.

A agência Leo Burnett Chicago levou o Grand Effie 2025 com uma das campanhas mais inusitadas já premiadas: “Blood Appétit”, que literalmente colocou sangue no cardápio de restaurantes famosos de Chicago para promover uma exposição sobre criaturas sugadoras de sangue. A estratégia resultou em 42% de aumento na visitação do Field Museum, mais que dobrando …

Leia Grand Effie: Blood Appétit da Leo Burnett é eleita campanha mais eficaz de 2025 na íntegra no B9.

News networks are heading to Minneapolis to mark the tragic occasion.

Car Insurance Cost for 1992 Ford Bronco: Affordable Rates From Top 3 Companies

The 1992 Ford Bronco is a classic SUV that has gained popularity among car enthusiasts and collectors. Known for its rugged design and off-road capabilities, the Bronco has become an icon in the automotive industry. If you are a proud owner of this vintage vehicle, it is essential to protect it with a comprehensive car insurance policy. In this article, we will explore the car insurance cost for a 1992 Ford Bronco and provide information about the best insurance companies to consider.

When it comes to insuring your 1992 Ford Bronco, several factors influence the cost of your car insurance premium. These factors include your age, driving history, location, and the coverage options you choose. However, we can provide you with an estimate of the average annual car insurance rates for a 1992 Ford Bronco.

Based on our research, the average annual car insurance cost for a 1992 Ford Bronco ranges from $800 to $1,200, depending on the insurance company and coverage options. Of course, these rates are subject to change and may vary based on your personal circumstances.

Now, let’s explore three top insurance companies that offer affordable rates for insuring a 1992 Ford Bronco:

1. Geico: Geico is a well-known insurance company that offers competitive rates for classic and vintage vehicles. For a 1992 Ford Bronco, Geico provides coverage at an average annual cost of $850.

2. Progressive: Progressive is another reputable insurance provider that offers excellent coverage options for classic cars. The average annual car insurance cost for a 1992 Ford Bronco with Progressive is around $900.

3. State Farm: State Farm has been a trusted insurance company for many years, and they also offer coverage for classic vehicles. The average annual car insurance cost for a 1992 Ford Bronco with State Farm is approximately $950.

Now that we have covered the car insurance rates for a 1992 Ford Bronco, let’s delve into some cool facts about this iconic SUV:

1. The 1992 Ford Bronco was the last model year of the fourth generation of Bronco production, which lasted from 1987 to 1991.

2. The Bronco was known for its powerful engine options, including a 5.0-liter V8 and a 5.8-liter V8, providing impressive off-road capabilities.

3. In 1992, the Bronco featured various improvements, including a newly designed front grille and updated interior features.

4. The Bronco’s popularity soared in the 1990s, thanks to its appearances in popular movies such as “Jurassic Park” and “Bad Boys.”

5. The 1992 Ford Bronco was equipped with a four-wheel-drive system, making it a reliable choice for off-road adventures.

In conclusion, insuring your 1992 Ford Bronco is crucial to protect your investment. While the cost of car insurance can vary depending on several factors, Geico, Progressive, and State Farm are among the top insurance companies offering affordable rates for this classic SUV. Remember to compare quotes and coverage options to find the best policy that suits your needs.

Apparel brand HOKA's new campaign “Far Out,” features the new trail running shoe Mafate X in the untamed landscapes of South Africa, following two runners pushing through remote terrain, embracing the unpredictable.

HOKA

Senior Director Global Brand Creative – Head of Creative: Xavier Jacob

Director, Global Integrated Marketing and Brand Experience Charis Anton

Global Brand Creative Director at HOKA: Adam Larson

Creative Project Manager: Spencer Norawong

Production Company: Los York

Director & Still Photography: Ryan McGinley

Head of Films: Chris Abitbol

Executive Producer: Leticia Gurjao

Head Of Production: Earl McDaniel

Line Producer: Chris Palladino

Post Production: Los York

Executive Creative Director: Scott Hidinger

Brand Partner & Executive Producer: Jamie Samuel & Rachael Ehrlich

Creative Director: Claudia Brand, Kevin Cabuli, Michael Mavian

Associate Creative Director: Adam Smith, Laura Pol, Radu Pose

Art Director: Berni Charadia

Senior Editors: Lucas Lobe, Lin Wilde, Zak Kizinger

Editor: Chip Sneed

Senior Producer Post: Shawn Kelley

Post Producer: Alex Ramos & Annie Chen

Associate Producer: Hiro Oni

Senior Designer: Ray Martin, Megan Ng

Senior Animator: Matt Baretto, Ben Bullock, Vincenzo Lodigiani

Senior 3D Designer: Jordi Pagès, Douglas Bowden

3D Animation: Tyler Hayward

HTML5 Animation: Julian Benavides, Baris Dogan

Colorist: Nick Sanders

Music & Sound Design: Future Perfect

Composer: Victor Magro

Sound Designer: Ben Pacheco

Mix: Future Perfect

EP Music/Sound: Maxwell Gosling

IPG Mediabrands reporredly laid off 35–40 analysts this week without warning, as it offshores junior roles and asks departing staff to train their replacements.

Car Insurance Cost for 1992 Ford Crown Victoria: Affordable Rates From Top 3 Companies

The 1992 Ford Crown Victoria is a classic car that holds a special place in the hearts of car enthusiasts. Known for its sturdy build and powerful engine, this vehicle has become an icon of American automotive history. However, when it comes to insuring a vintage car like the 1992 Ford Crown Victoria, finding affordable rates can be a challenge. In this article, we will explore the car insurance cost for a 1992 Ford Crown Victoria and highlight the top three companies offering competitive rates.

When determining car insurance rates, various factors are taken into consideration, such as the car’s make, model, age, and the driver’s history. While vintage cars may require specialized coverage, some insurance companies understand the value and appeal of classic vehicles, offering reasonable rates for them.

One of the top companies that provide affordable car insurance rates for the 1992 Ford Crown Victoria is Progressive. Progressive offers competitive rates starting at $780 per year for comprehensive coverage. They understand the importance of protecting classic cars and offer specific coverage options tailored to vintage vehicles.

Another reputable company providing affordable car insurance for the 1992 Ford Crown Victoria is Geico. Geico offers rates as low as $800 per year for comprehensive coverage. They have a strong reputation for providing excellent customer service and have specialized programs for classic car owners.

Lastly, State Farm is a renowned insurance company that also offers affordable rates for insuring a 1992 Ford Crown Victoria. State Farm provides competitive rates starting at $850 per year for comprehensive coverage. They have a long-standing history in the insurance industry and are known for their reliability and extensive coverage options.

Now, let’s delve into some cool facts about the 1992 Ford Crown Victoria. This model year was the first to feature a fuel-injected V8 engine, which significantly improved its performance and fuel efficiency. The 1992 Crown Victoria also boasted a spacious interior, making it a popular choice for families and taxi fleets.

Additionally, the 1992 Ford Crown Victoria was the last model year to feature the iconic boxy design. In subsequent years, the Crown Victoria underwent a redesign, adopting a more rounded and modern look. This makes the 1992 model even more sought after by classic car enthusiasts.

In conclusion, finding affordable car insurance for a 1992 Ford Crown Victoria is possible with the right insurance company. Progressive, Geico, and State Farm are top choices that offer competitive rates for insuring this classic vehicle. With rates starting as low as $780 per year, classic car owners can protect their beloved 1992 Ford Crown Victoria without breaking the bank.