Texas-Based Indie Shop Bakery Wins Sendero Provisions Account

Posted in: UncategorizedThe western wear company selected the agency for creative, media, and content.

The western wear company selected the agency for creative, media, and content.

Car Insurance Cost for 1992 Chevrolet Suburban 1500: Affordable Rates From Top 3 Companies

The 1992 Chevrolet Suburban 1500 is a classic American SUV that has stood the test of time. Known for its durability and spaciousness, this vehicle has become a favorite among families and outdoor enthusiasts alike. If you are a proud owner of this vintage SUV, it is important to ensure that you have the right car insurance coverage to protect your investment. In this article, we will explore the affordable rates offered by the top three insurance companies for the 1992 Chevrolet Suburban 1500, along with some interesting facts about the vehicle.

1. Progressive Insurance: Progressive is one of the leading car insurance providers in the United States, known for its competitive rates and excellent customer service. For a 1992 Chevrolet Suburban 1500, Progressive offers an average annual premium of $800. This rate may vary depending on factors such as your location, driving history, and coverage options. Progressive provides a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

2. Geico Insurance: Geico is another top-rated insurance company that offers affordable rates for the 1992 Chevrolet Suburban 1500. Geico’s average annual premium for this vehicle is around $850. Like Progressive, Geico provides various coverage options and discounts to help you customize your policy according to your needs and budget. Additionally, Geico offers 24/7 customer service and a user-friendly mobile app for easy claims management.

3. State Farm Insurance: State Farm is widely recognized for its reliable coverage and personalized service. For the 1992 Chevrolet Suburban 1500, State Farm offers an average annual premium of approximately $900. State Farm provides a range of coverage options, including liability, collision, comprehensive, medical payments, and personal injury protection. They also offer various discounts, such as multi-policy, good student, and safe driving discounts.

Now, let’s dive into some cool facts about the 1992 Chevrolet Suburban 1500:

1. The 1992 Suburban featured a powerful 5.7-liter V8 engine, capable of producing 210 horsepower and 300 lb-ft of torque. This allowed for a towing capacity of up to 7,500 pounds, making it an excellent choice for hauling trailers or boats.

2. With its three rows of seating, the Suburban could accommodate up to nine passengers comfortably. This made it a popular choice for large families or those who needed ample space for both passengers and cargo.

3. The 1992 Suburban introduced several safety features, including antilock brakes and driver-side airbags. These advancements helped improve the overall safety of the vehicle, making it more appealing to buyers.

In conclusion, owning a 1992 Chevrolet Suburban 1500 comes with its own set of insurance considerations. However, with the affordable rates offered by the top three insurance companies – Progressive, Geico, and State Farm – you can find suitable coverage to protect your beloved SUV. Additionally, the 1992 Suburban’s powerful engine, spacious interior, and safety features make it a timeless classic that continues to capture the hearts of car enthusiasts worldwide.

|

|

|

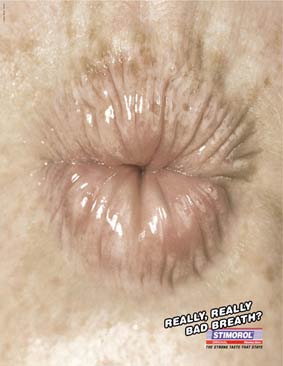

| THE ORIGINAL? Stimorol – 2005 « bad breath? » Lions Shortlist Lowe Bull (AFS) |

LESS ORIGINAL Coway, Electronic Bidets – 2010 « We love your tush » Source : La Réclame Agency : Innocean (South Korea) |

LESS ORIGINAL Bidetlity, Butt Shower – 2025 « So clean, you can kiss it » Source : LLB Online Agency : Joan Berlin (Germany) |

Exclusive: Latest ‘Cashback Like a Pro’ ad uses Hartbeat production company and highlights Chase NBA and WNBA investment.

Car Insurance Cost for 1992 Chevrolet Suburban 2500: Affordable Rates From Top 3 Companies

The 1992 Chevrolet Suburban 2500 is a classic SUV that has garnered a loyal following over the years. Known for its durability and spaciousness, this vehicle continues to be a popular choice for families and outdoor enthusiasts. If you are a proud owner of a 1992 Chevrolet Suburban 2500, you may be wondering about the cost of insuring your beloved vehicle. In this article, we will explore the car insurance rates for this particular model from three top insurance companies and provide you with some cool facts about the car.

When it comes to insuring your 1992 Chevrolet Suburban 2500, it’s important to find the right coverage at an affordable rate. To help you with your decision, we have gathered information from three leading insurance companies: GEICO, State Farm, and Progressive. Please note that these rates are subject to change and may vary depending on several factors such as your location, driving history, and coverage preferences.

GEICO offers competitive rates for insuring a 1992 Chevrolet Suburban 2500. On average, their annual premium for this vehicle ranges from $800 to $1,200, depending on your coverage needs and location. GEICO is known for its excellent customer service and comprehensive coverage options, making it a popular choice among car owners.

State Farm is another reputable insurance company that offers affordable rates for the 1992 Chevrolet Suburban 2500. Their average annual premium for this model ranges from $900 to $1,300, depending on various factors. State Farm is known for its extensive network of agents, making it convenient for customers to access their services and get personalized assistance when needed.

Progressive is also a popular choice for insuring a 1992 Chevrolet Suburban 2500. Their average annual premium for this vehicle ranges from $850 to $1,400, depending on your location and coverage preferences. Progressive is known for its user-friendly online platform, making it easy for customers to manage their policies and claims.

Now, let’s delve into some cool facts about the 1992 Chevrolet Suburban 2500. This vehicle was part of the ninth generation of Suburbans, which were produced from 1992 to 1999. The 1992 model featured a robust V8 engine, capable of producing 190 horsepower. It boasted an impressive towing capacity of up to 10,000 pounds, making it an ideal choice for hauling heavy loads.

The 1992 Chevrolet Suburban 2500 also had a spacious interior, with seating for up to nine passengers. It offered ample cargo space, making it perfect for family trips or outdoor adventures. This model was renowned for its durability, and many owners reported driving their Suburbans for well over 200,000 miles.

In conclusion, insuring a 1992 Chevrolet Suburban 2500 can be affordable, especially when choosing from reputable insurance companies like GEICO, State Farm, and Progressive. The rates mentioned above are a general estimate, so it’s recommended to obtain personalized quotes based on your specific circumstances. With its ruggedness and spaciousness, the 1992 Chevrolet Suburban 2500 continues to be a beloved vehicle among car enthusiasts, providing both functionality and style.

IHOP rode with Dale Earnhardt Jr. in Amazon’s NASCAR debut as the Coca-Cola 600 fit the brand’s sports streaming strategy.

Car Insurance Cost for 1992 Chrysler Fifth Ave: Affordable Rates From Top 3 Companies

The cost of car insurance is an important consideration for any vehicle owner, and the 1992 Chrysler Fifth Ave is no exception. Known for its elegant design and powerful performance, this classic car still holds a special place in the hearts of many automobile enthusiasts. If you are a proud owner of a 1992 Chrysler Fifth Ave, it is essential to find the right car insurance coverage at an affordable rate. In this article, we will explore the top three companies offering competitive rates for insuring this particular vehicle, along with some cool facts about the car itself.

1. Geico:

Geico is a well-known insurance company that offers affordable rates for various vehicles, including the 1992 Chrysler Fifth Ave. For this classic car, Geico offers an annual premium rate of around $900. With their excellent customer service and user-friendly online tools, Geico is a popular choice for many car owners.

2. Progressive:

Progressive is another reputable insurance provider that caters to the needs of classic car owners. For the 1992 Chrysler Fifth Ave, Progressive offers an annual premium rate of approximately $1,000. With their customizable coverage options and a range of discounts, Progressive ensures that you get the right coverage at a competitive price.

3. State Farm:

State Farm is a trusted insurance company that has been serving customers for decades. They also provide coverage for the 1992 Chrysler Fifth Ave at an annual premium rate of around $1,200. State Farm offers various discounts, such as safe driver discounts and multi-policy discounts, which can help reduce the overall insurance cost.

Now, let’s delve into some cool facts about the 1992 Chrysler Fifth Ave:

1. Luxurious Interior: The 1992 Chrysler Fifth Ave boasted a luxurious interior with plush velour seating, genuine wood accents, and electronic instrument clusters. It was designed to provide a comfortable and elegant driving experience.

2. Powertrain: The vehicle came equipped with a 3.3-liter V6 engine, delivering a respectable 147 horsepower. This engine provided smooth acceleration and ample power for cruising on the highways.

3. Safety Features: The 1992 Chrysler Fifth Ave was equipped with anti-lock brakes (ABS) and driver-side airbags, which were relatively advanced safety features for that era.

4. Classic Design: The car showcased a classic design, featuring a large chrome grille, squared-off body lines, and a distinctive hood ornament. Its timeless appearance still turns heads on the roads today.

5. Longevity: The 1992 Chrysler Fifth Ave was known for its durability and longevity. Many enthusiasts still own and maintain these vehicles, thanks to their solid construction and reliable performance.

In conclusion, finding affordable car insurance for your 1992 Chrysler Fifth Ave is possible by considering the rates offered by Geico, Progressive, and State Farm. These companies provide competitive rates and excellent coverage options for this classic car. With its luxurious interior, powerful engine, and timeless design, the 1992 Chrysler Fifth Ave continues to captivate car enthusiasts around the world.

Car Insurance Cost for 1992 Chrysler LeBaron: Affordable Rates From Top 3 Companies

Owning a vintage car like the 1992 Chrysler LeBaron can be a thrilling experience. However, it’s important to protect your investment by obtaining the right car insurance coverage. In this article, we will explore some affordable insurance options from the top three companies for the 1992 Chrysler LeBaron, along with some cool facts about the car.

1. GEICO:

GEICO is known for providing competitive rates and excellent customer service. For a 1992 Chrysler LeBaron, GEICO offers affordable insurance options. On average, the annual premium for full coverage is around $700. This rate may vary depending on factors such as the driver’s age, location, and driving history. GEICO also offers various discounts, such as multi-policy, good student, and safe driver discounts, which can help lower the overall cost.

2. Progressive:

Progressive is another well-known insurance company that offers reasonable rates for the 1992 Chrysler LeBaron. Their annual premium for full coverage typically ranges from $650 to $750. Progressive is known for its customizable policies, allowing drivers to tailor their coverage options to fit their needs. They also offer a wide range of discounts, including multi-car, homeowner, and continuous insurance discounts, which can further reduce the insurance cost.

3. State Farm:

State Farm is a trusted insurance provider that offers competitive rates for the 1992 Chrysler LeBaron. On average, the annual premium for full coverage with State Farm is around $750. State Farm is known for its extensive network of agents, providing personalized service to policyholders. They also offer various discounts, such as safe driving, anti-theft device, and multi-vehicle discounts, which can help lower the insurance cost even more.

Now, let’s delve into some cool facts about the 1992 Chrysler LeBaron:

1. The 1992 Chrysler LeBaron was part of the fourth generation of LeBaron models, which were produced from 1987 to 1995.

2. The LeBaron was available in multiple body styles, including a two-door convertible, a two-door coupe, and a four-door sedan.

3. It featured a sleek and aerodynamic design, with a stylish front grille and rounded edges.

4. The 1992 LeBaron came equipped with a 3.0-liter V6 engine, delivering a decent amount of power for its time.

5. It offered various luxurious features, such as power windows, leather seats, and a premium sound system, making it a comfortable and enjoyable ride.

6. The LeBaron was praised for its smooth handling and comfortable suspension, making it a popular choice among drivers seeking a blend of style and performance.

7. The 1992 LeBaron was also known for its reliability, with many owners reporting few mechanical issues and long-lasting performance.

In conclusion, obtaining car insurance coverage for your 1992 Chrysler LeBaron doesn’t have to break the bank. Companies like GEICO, Progressive, and State Farm offer affordable rates for this vintage car. Remember to compare quotes, consider available discounts, and choose the coverage that suits your needs. With the right insurance, you can protect your investment and enjoy the unique experience of owning a classic car like the 1992 Chrysler LeBaron.

The attention metric vendor Adelaide unveiled a new marketplace, called the AU Ecosystem, with more than 40 sell-side participants.

Car Insurance Cost for 1992 Chrysler Imperial: Affordable Rates From Top 3 Companies

If you are a proud owner of a 1992 Chrysler Imperial, it is important to secure a comprehensive car insurance policy to protect yourself and your vehicle. Car insurance rates can vary depending on several factors, including the make, model, and year of your car. In the case of a 1992 Chrysler Imperial, you will be pleased to know that this classic vehicle is generally considered affordable to insure.

Let’s explore the rates offered by the top three car insurance companies for a 1992 Chrysler Imperial:

1. Progressive Insurance: Progressive offers competitive rates for insuring a 1992 Chrysler Imperial. Their comprehensive coverage comes at an average annual cost of around $1,200. With Progressive, you can benefit from their wide range of coverage options, including liability, collision, and comprehensive insurance.

2. State Farm Insurance: State Farm is another reputable insurance provider that offers affordable rates for insuring a 1992 Chrysler Imperial. Their comprehensive coverage for this classic car comes at an average annual cost of approximately $1,300. State Farm is known for its excellent customer service and extensive network of agents, making it a popular choice among car owners.

3. GEICO Insurance: GEICO is renowned for its competitive rates, and insuring a 1992 Chrysler Imperial is no exception. Their comprehensive coverage for this classic vehicle is available at an average annual cost of around $1,100. GEICO is known for its user-friendly online platform, making it easy for customers to manage their policies and make claims.

Now, let’s dive into some cool facts about the 1992 Chrysler Imperial:

1. Elegant Design: The 1992 Chrysler Imperial featured a sleek and sophisticated design, with its elongated body and distinctive grille. It was considered a luxury vehicle, boasting an impressive level of comfort and style.

2. Technological Innovations: The 1992 Chrysler Imperial was equipped with various advanced features for its time. It included an automatic climate control system, power-adjustable seats, and a digital instrument cluster. These technological advancements added to the overall appeal of the vehicle.

3. Limited Production: Only 6,970 units of the 1992 Chrysler Imperial were produced, making it a rare find today. Its exclusivity adds to its value among collectors and enthusiasts.

4. Smooth Ride: The 1992 Chrysler Imperial was praised for its smooth and comfortable ride. It was equipped with a powerful V6 engine, providing ample power and a refined driving experience.

In conclusion, insuring a 1992 Chrysler Imperial does not have to break the bank. Progressive, State Farm, and GEICO offer competitive rates for comprehensive coverage, ensuring that your classic car is protected. With its elegant design, technological innovations, limited production, and smooth ride, the 1992 Chrysler Imperial remains a timeless classic among car enthusiasts.

Car insurance cost is an essential consideration for any vehicle owner, and the 1992 Chrysler Town & Country is no exception. Known for its spaciousness and reliability, this minivan remains a popular choice for families even today. In this article, we will explore affordable car insurance rates from the top three companies specifically tailored for the 1992 Chrysler Town & Country, along with some fascinating facts about this iconic vehicle.

When it comes to insuring your 1992 Chrysler Town & Country, three insurance providers stand out for their competitive rates and comprehensive coverage options. These companies are Geico, Progressive, and State Farm. Each of them offers unique features that cater to the needs of Town & Country owners, ensuring they receive the best coverage at affordable prices.

Starting with Geico, they provide a variety of coverage options for the 1992 Chrysler Town & Country. For a liability-only policy, their rates start at an affordable $450 per year. If you prefer a more comprehensive coverage plan, Geico offers full coverage options starting at approximately $800 per year. Geico’s reputation for exceptional customer service and hassle-free claims handling makes them an attractive choice for Town & Country owners.

Progressive is another top insurance company that provides affordable rates for the 1992 Chrysler Town & Country. Their liability-only coverage starts at around $500 per year, while full coverage options begin at approximately $850 per year. Progressive is known for their flexible payment plans and various discounts, such as their Snapshot program, which rewards safe driving habits with potential discounts on premiums.

State Farm, renowned for its extensive network of agents, also offers competitive rates for insuring the 1992 Chrysler Town & Country. Their liability-only coverage starts at around $550 per year, with full coverage options beginning at approximately $900 per year. State Farm’s robust online tools and personalized service make it easy for Town & Country owners to access and manage their policies.

Now, let’s delve into some cool facts about the 1992 Chrysler Town & Country. This minivan was part of the fourth generation of the Town & Country series, which was produced from 1990 to 1995. It featured a 3.3-liter V6 engine with a four-speed automatic transmission, providing a smooth and comfortable ride for passengers.

The 1992 model year introduced several upgrades, including a redesigned interior with improved seating and increased cargo space. It also boasted a sophisticated electronic instrument cluster and a rear-view mirror with an integrated digital compass. These features enhanced the overall driving experience and made the Town & Country a popular choice among families.

In conclusion, insuring your 1992 Chrysler Town & Country can be affordable and hassle-free with the right insurance company. Geico, Progressive, and State Farm are among the top providers offering competitive rates specifically tailored for this iconic minivan. With their comprehensive coverage options and exceptional customer service, these companies ensure that Town & Country owners have peace of mind while driving their beloved vehicle.

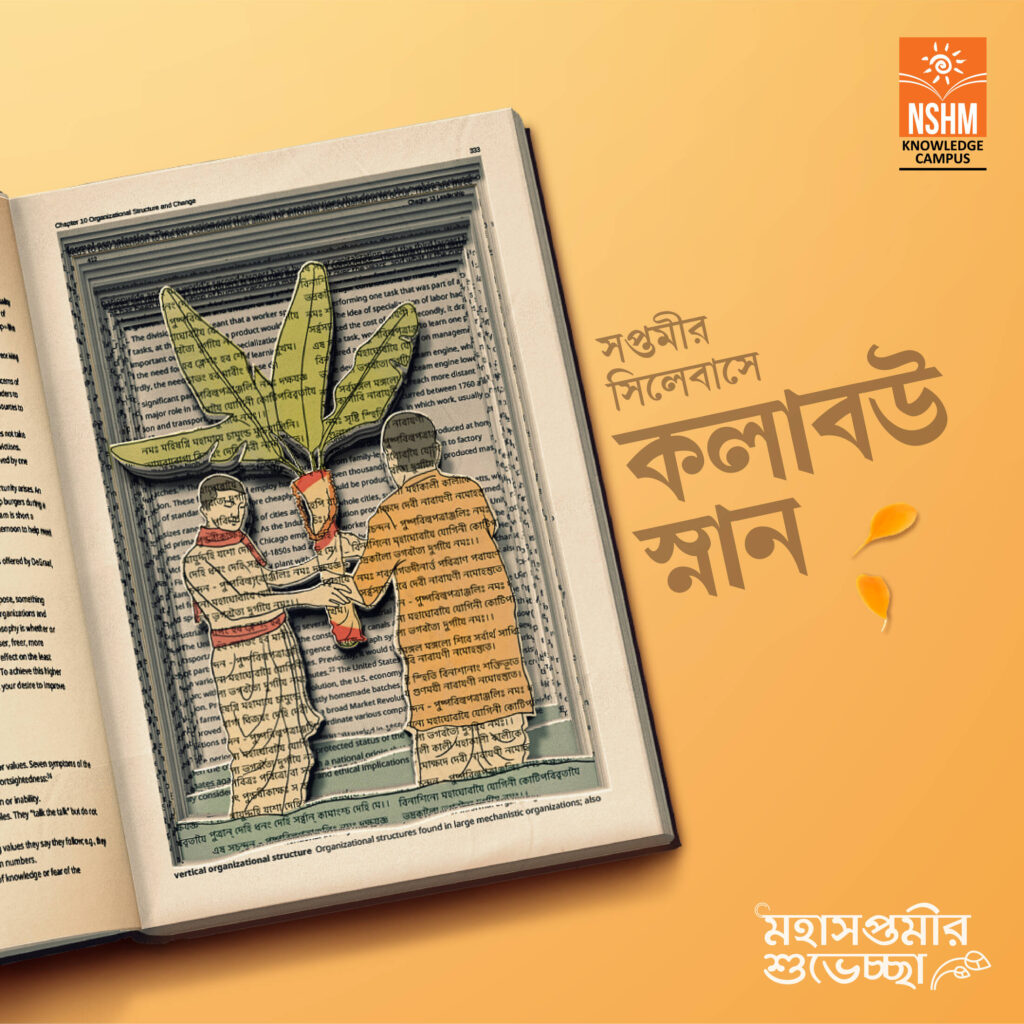

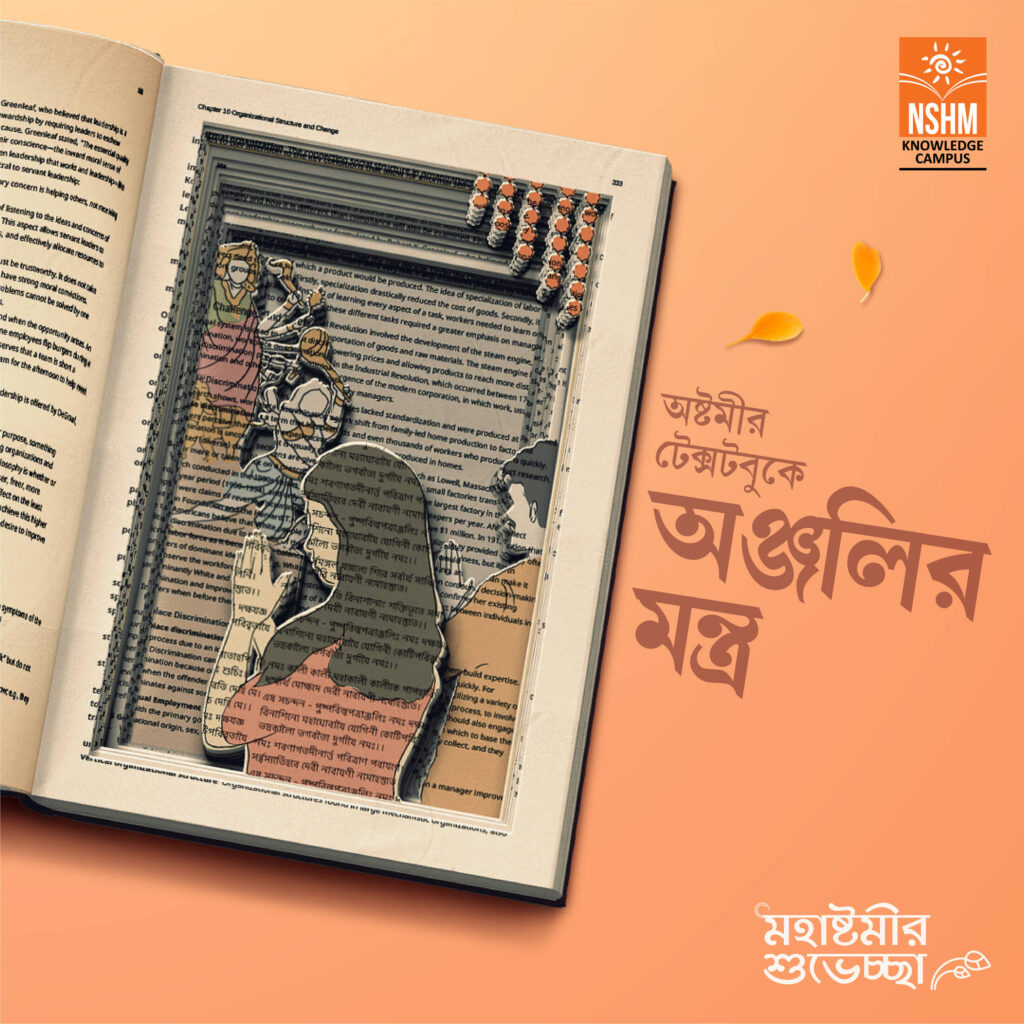

Client: NSHM Knowledge Campus

Agency: Inner Circle Advertising

Art Director: Avishek Naha

Illustrator: Suchismita Dey

Copywriter: Sujahan Das

Account Manager: Tridipta Dey

Client Servicing Executive: Itakshi Chakraborty

Car Insurance Cost for 1992 Chrysler New Yorker: Affordable Rates From Top 3 Companies

When it comes to car insurance, finding affordable rates is always a priority. If you own a 1992 Chrysler New Yorker, you’ll be pleased to know that there are several insurance companies that offer competitive rates for this classic vehicle. In this article, we will explore the top three insurance companies that provide affordable coverage for the 1992 Chrysler New Yorker, along with some cool facts about the car.

1. Geico Insurance:

Geico is known for its affordable rates and excellent customer service. For a 1992 Chrysler New Yorker, Geico offers comprehensive coverage at a rate of approximately $800 per year. This includes liability coverage, collision coverage, and comprehensive coverage. Geico also offers various discounts, such as safe driver discounts and multi-policy discounts, which can further reduce your insurance costs.

2. Progressive Insurance:

Progressive is another reputable insurance company that provides competitive rates for the 1992 Chrysler New Yorker. Their comprehensive coverage for this vehicle is available at an average rate of around $850 per year. Progressive offers various additional coverage options, such as roadside assistance and rental car reimbursement, which can be beneficial for owners of older vehicles like the New Yorker.

3. State Farm Insurance:

State Farm is a well-known insurance provider that offers comprehensive coverage for the 1992 Chrysler New Yorker at an average rate of about $900 per year. State Farm is known for its personalized service and flexible coverage options. They also offer various discounts, such as good driver discounts and discounts for completing defensive driving courses, which can help lower your insurance costs even further.

Now, let’s delve into some cool facts about the 1992 Chrysler New Yorker:

1. Luxurious Features:

The 1992 Chrysler New Yorker was known for its luxurious features, including a plush interior, power-adjustable seats, and a sophisticated sound system. It was designed to provide a smooth and comfortable driving experience.

2. Safety Features:

This car was equipped with several safety features, such as anti-lock brakes, dual front airbags, and traction control. These features were ahead of their time and contributed to the New Yorker’s reputation as a safe vehicle.

3. Engine Specifications:

The 1992 Chrysler New Yorker came with a 3.3-liter V6 engine, capable of producing 147 horsepower. It offered a balance between power and fuel efficiency, making it an ideal choice for daily commuting and long-distance travel.

4. Classic Design:

The New Yorker had a distinctive design, with its sleek lines and chrome accents. It exuded an air of elegance and sophistication, making it a popular choice among car enthusiasts and collectors.

In conclusion, if you own a 1992 Chrysler New Yorker, you can find affordable car insurance rates from top companies like Geico, Progressive, and State Farm. These companies offer comprehensive coverage at rates ranging from $800 to $900 per year. Additionally, the New Yorker is an iconic vehicle known for its luxurious features, safety enhancements, and elegant design, making it a timeless classic in the automotive world.

Car Insurance Cost for 1992 Daihatsu Rocky: Affordable Rates From Top 3 Companies

If you own a 1992 Daihatsu Rocky, it’s essential to have car insurance to protect yourself and your vehicle in case of an accident or other unforeseen circumstances. While car insurance rates can vary depending on various factors, such as your location, driving history, and coverage options, we will explore the affordable rates offered by three top insurance companies for your 1992 Daihatsu Rocky.

1. GEICO Insurance:

GEICO is known for offering competitive rates and quality coverage. For a 1992 Daihatsu Rocky, GEICO provides affordable car insurance options. The average annual premium for liability coverage for a Daihatsu Rocky is around $400. If you opt for comprehensive and collision coverage, the average annual premium can go up to approximately $800. GEICO’s rates may vary depending on several factors, including your driving record, location, and coverage options.

2. Progressive Insurance:

Progressive is another reputable insurance company that provides affordable rates for a 1992 Daihatsu Rocky. The average annual premium for liability coverage is around $450, while comprehensive and collision coverage may cost you approximately $900 per year. Progressive also offers various discounts, such as multi-car, safe driver, and bundled policies, which can further reduce your insurance costs. Your premium may vary based on your specific circumstances.

3. State Farm Insurance:

State Farm is widely recognized for its excellent customer service and comprehensive coverage options. For a 1992 Daihatsu Rocky, State Farm offers competitive rates. The average annual premium for liability coverage is around $500, while comprehensive and collision coverage may cost you approximately $1,000 per year. State Farm also provides various discounts, such as good student, defensive driving, and multi-policy discounts, which can help lower your insurance costs.

Now, let’s delve into some cool facts about the 1992 Daihatsu Rocky:

1. The 1992 Daihatsu Rocky was a compact SUV that was popular for its off-road capabilities. It featured a rugged design and a powerful engine, making it suitable for adventurous journeys.

2. The Rocky was equipped with a 1.6-liter four-cylinder engine, providing adequate power for its size. It offered a manual transmission with both two-wheel and four-wheel drive options.

3. The 1992 Daihatsu Rocky boasted impressive ground clearance, enabling it to navigate challenging terrains effortlessly. Its robust suspension and solid axles contributed to its off-road prowess.

4. Despite its compact size, the Rocky provided a spacious and comfortable interior. It could accommodate up to five passengers and offered ample cargo space.

5. The 1992 Daihatsu Rocky was known for its reliability and durability. Many owners praised its longevity and ability to withstand rough driving conditions.

In conclusion, owning a 1992 Daihatsu Rocky comes with the responsibility of having car insurance. Fortunately, top insurance companies like GEICO, Progressive, and State Farm offer affordable rates for this vehicle. By comparing quotes and considering various coverage options, you can find the best insurance policy to protect your 1992 Daihatsu Rocky without breaking the bank.

Car Insurance Cost for 1992 Dodge D350 Club Cab: Affordable Rates From Top 3 Companies

When it comes to insuring a 1992 Dodge D350 Club Cab, it’s important to find the right car insurance coverage at an affordable rate. This classic truck, known for its durability and power, requires coverage that not only protects the vehicle but also provides peace of mind for the driver. In this article, we explore the average car insurance cost for a 1992 Dodge D350 Club Cab and highlight the rates offered by three top insurance companies. Additionally, we’ll share some cool facts about this iconic vehicle.

The average annual car insurance cost for a 1992 Dodge D350 Club Cab can vary depending on various factors, including the driver’s age, location, driving record, and coverage needs. On average, the cost ranges from $800 to $1,400 per year. However, it’s important to note that these rates are merely estimates and can vary significantly based on individual circumstances.

To help you get an idea of the rates offered by some top insurance companies, here are three examples:

1. State Farm: State Farm is known for its competitive rates and excellent customer service. For a 1992 Dodge D350 Club Cab, their average annual premium is around $900, which makes it an affordable option for many drivers.

2. GEICO: GEICO is another popular choice for car insurance. They offer competitive rates and a reputation for excellent claims handling. With GEICO, you can expect to pay an average of $850 per year to insure your 1992 Dodge D350 Club Cab.

3. Progressive: Progressive is known for its innovative approach to car insurance and affordable rates. Their average annual premium for a 1992 Dodge D350 Club Cab is approximately $1,000, making it a viable option for drivers seeking comprehensive coverage.

Now, let’s dive into some cool facts about the 1992 Dodge D350 Club Cab:

1. Powerhouse Engine: The 1992 Dodge D350 Club Cab came equipped with a 5.9-liter V8 engine, offering impressive power and towing capabilities. With 230 horsepower and 330 lb-ft of torque, this truck was built to handle heavy loads.

2. Spacious Interior: The Club Cab configuration provided ample space for both passengers and cargo. With a comfortable bench seat in the front and additional seating in the back, it could accommodate up to six people.

3. Classic Design: The 1992 Dodge D350 Club Cab featured a timeless design with its signature chrome grille, bold lines, and square body. Its rugged appearance made it an instant favorite among truck enthusiasts.

In conclusion, insuring a 1992 Dodge D350 Club Cab can be affordable if you choose the right insurance company. State Farm, GEICO, and Progressive offer competitive rates for this iconic truck. With the average cost ranging between $800 and $1,400 per year, drivers can find coverage that suits their needs and budget. The 1992 Dodge D350 Club Cab’s powerful engine, spacious interior, and classic design make it a beloved vehicle among truck enthusiasts.

Dozens of A.I.-related regulations enacted in the past two years now lead to fines, incarceration and legal challenges from the likes of Elon Musk.

Car insurance is an important aspect of owning a vehicle, and finding affordable rates for your specific make and model can help save you money in the long run. In this article, we will discuss the car insurance cost for a 1992 Dodge Caravan Passenger and explore some interesting facts about this iconic vehicle.

When it comes to insuring a 1992 Dodge Caravan Passenger, there are a few factors that insurance companies consider. These include the vehicle’s age, condition, safety features, and the driver’s personal information. All these factors collectively determine the insurance premium for this particular vehicle.

To provide you with a better understanding of the car insurance cost for a 1992 Dodge Caravan Passenger, we will highlight the rates offered by three top insurance companies:

1. Geico Insurance: Geico is renowned for providing competitive rates to its customers. For a 1992 Dodge Caravan Passenger, Geico offers a comprehensive coverage plan at an average annual rate of $800. This rate may vary based on factors such as your location, driving history, and credit score.

2. State Farm Insurance: State Farm is another reputable insurance company that offers comprehensive coverage for the 1992 Dodge Caravan Passenger. Their average annual rate for this vehicle is around $900. However, it is important to note that this rate may differ based on your personal circumstances and location.

3. Progressive Insurance: Progressive is known for its flexible coverage options and affordable rates. For a 1992 Dodge Caravan Passenger, Progressive offers an average annual premium of approximately $950. Remember that this rate can fluctuate depending on various factors, including your driving record and location.

Now, let’s delve into some cool facts about the 1992 Dodge Caravan Passenger:

1. Revolutionary Design: The 1992 Dodge Caravan Passenger was part of the fourth generation of the Caravan series. It introduced a more aerodynamic design, setting a new trend for minivans in the market.

2. Safety Features: This model was equipped with several safety features, including anti-lock brakes, driver-side airbags, and child safety locks. These features contributed to the vehicle’s overall safety rating.

3. Versatility: The 1992 Dodge Caravan Passenger offered a versatile seating arrangement, allowing for multiple configurations to accommodate passengers and cargo. This made it a popular choice for families and commercial use alike.

4. Longevity: The Dodge Caravan series has stood the test of time, and the 1992 model was no exception. Many owners reported that their Caravans lasted well over 200,000 miles, showcasing the vehicle’s durability and long lifespan.

In conclusion, insuring a 1992 Dodge Caravan Passenger can be affordable if you compare rates from top insurance companies. Geico, State Farm, and Progressive offer competitive prices for this iconic minivan. Additionally, the 1992 Dodge Caravan Passenger was a revolutionary vehicle with its aerodynamic design, advanced safety features, versatility, and long-lasting performance.

Car insurance is an essential aspect of owning a vehicle, providing financial protection in case of accidents, damage, or theft. When it comes to insuring a 1992 Dodge Caravan Cargo, there are several factors that influence the cost, including the specific model, driver’s profile, and insurance provider. In this article, we will explore the average car insurance rates for this vehicle and highlight three top companies offering affordable coverage. Additionally, we will share some interesting facts about the 1992 Dodge Caravan Cargo.

The cost of car insurance for a 1992 Dodge Caravan Cargo can vary based on multiple factors such as the driver’s age, location, driving history, and coverage requirements. However, on average, the annual insurance cost for this vehicle ranges between $800 and $1,200. Keep in mind that these rates are just estimates, and the final cost may differ depending on the individual circumstances.

Now, let’s take a look at three leading insurance companies that offer affordable rates for insuring a 1992 Dodge Caravan Cargo:

1. Progressive: Known for their competitive rates and excellent customer service, Progressive offers comprehensive coverage for the 1992 Dodge Caravan Cargo at an average annual cost of $850.

2. GEICO: GEICO is another popular choice for affordable car insurance. They provide various coverage options for the 1992 Dodge Caravan Cargo, with an average annual premium of approximately $900.

3. State Farm: As one of the largest insurance providers in the United States, State Farm offers reliable coverage for the 1992 Dodge Caravan Cargo. Their average annual insurance cost for this vehicle is around $950.

Now that we have covered the insurance rates, let’s delve into some interesting facts about the 1992 Dodge Caravan Cargo. This model was part of the fourth generation of the Dodge Caravan, which introduced several advancements in safety and functionality. It featured a spacious cargo area, making it an ideal choice for commercial purposes or as a family vehicle.

The 1992 Dodge Caravan Cargo offered a range of engine options, including a 2.5-liter four-cylinder engine and a more powerful 3.0-liter V6 engine. It boasted a sturdy construction, comfortable seating, and a smooth ride.

This model also had some innovative features for its time, such as available anti-lock brakes, driver-side airbags, and optional all-wheel drive. These safety features contributed to its popularity and helped establish the Dodge Caravan as one of the leading minivan models in the market.

In conclusion, insuring a 1992 Dodge Caravan Cargo can be affordable, with average annual rates ranging between $800 and $1,200. Progressive, GEICO, and State Farm are among the top insurance companies offering competitive rates for this vehicle. With its spacious cargo capacity and advanced safety features, the 1992 Dodge Caravan Cargo remains a reliable and practical choice for various purposes.

WPP has appointed Marie-Claire Barker as global chief people officer, ADWEEK has learned. Barker, who assumes the role at the beginning of June, succeeds Lindsay Pattison, who announced in February […]

Car Insurance Cost for 1992 Dodge D150 Club Cab: Affordable Rates From Top 3 Companies

When it comes to insuring a 1992 Dodge D150 Club Cab, finding affordable rates can be a top priority for many car owners. To help you in your search, we have compiled a list of the top three companies offering competitive rates for car insurance on this particular model.

1. Progressive Insurance: Progressive is known for its competitive rates and excellent customer service. For a 1992 Dodge D150 Club Cab, Progressive offers coverage at an average annual rate of $800. This rate is based on factors such as the driver’s age, driving history, and location. Progressive also offers various discounts, such as multi-car, multi-policy, and safe driver discounts, which can help further reduce the cost of insurance.

2. Geico Insurance: Geico is another popular choice for car insurance. For a 1992 Dodge D150 Club Cab, Geico offers coverage at an average annual rate of $850. Geico is known for its user-friendly online platform, making it easy to obtain quotes and manage your policy. They also offer discounts for safe driving, good grades (for students), and military service, among others.

3. State Farm Insurance: State Farm is a well-established insurance company that offers competitive rates for the 1992 Dodge D150 Club Cab. Their average annual rate for this model is around $900. State Farm is known for its personalized customer service and wide range of coverage options. They also offer discounts for safe driving, good grades, and having multiple policies with them.

Now, let’s dive into some cool facts about the 1992 Dodge D150 Club Cab:

1. The 1992 Dodge D150 Club Cab was part of the fifth-generation D-Series trucks, which were produced from 1981 to 1993. These trucks were known for their durability and ruggedness.

2. The Club Cab configuration offered extra seating space behind the front seats, making it a popular choice for families or those needing additional passenger capacity.

3. The 1992 Dodge D150 Club Cab came equipped with a 5.2-liter V8 engine, offering ample power for towing and hauling. This engine was paired with either a 3-speed automatic or 5-speed manual transmission.

4. Safety features on the 1992 Dodge D150 Club Cab included anti-lock brakes, driver-side airbags, and rear-wheel drive for improved handling and stability.

5. In terms of fuel economy, the 1992 Dodge D150 Club Cab averaged around 13-16 miles per gallon, depending on driving conditions and usage.

In conclusion, insuring a 1992 Dodge D150 Club Cab can be affordable, with rates starting at around $800 per year from top insurance companies such as Progressive, Geico, and State Farm. These companies offer competitive rates and various discounts to help reduce the cost of insurance. The 1992 Dodge D150 Club Cab is a durable and powerful truck, perfect for those seeking a reliable and versatile vehicle.